How to Measure a Roof With a Drone [Updated April 2023]

Roofing is a dangerous industry. Historically, that danger started during the inspection process for estimators before contracts were even signed. An estimator would need to: Remove the ladder from their truck Equip safety equipment depending on the pitch of the roof Place the ladder and climb the roof Meticulously take measurements of every facet, often […]

Is AI in Insurance Replacing Adjusters?

Since artificial intelligence (AI) was invented, people have been worried they would become too smart, become self-aware, and take over the world like Cyberdyne’s Skynet system in the Terminator franchise. Well, it’s been more than 70 years since Alan Turing’s famous paper on thinking machines, and we’re still telling them what to do – even […]

AI and the Future of P&C Insurance

In the face of escalating natural disasters, the insurance industry is at a crossroads. The choice? Stick with the status quo and struggle under the weight of outdated systems and processes or embrace AI and its myriad opportunities for transformation. For insurers who choose the latter, the future looks not just manageable but bright. AI […]

Innovation in Insurance: Reducing LAE and Cycle Times

Digital transformation is key to cutting Loss Adjustment Expenses (LAE) and improving cycle times in Property & Casualty Insurance (P&C). LAE can represent as much as 80% of a policyholder’s premium. The claims management process must be managed efficiently for insurers to stay profitable and competitive. This article explores the influence of advanced technologies, like […]

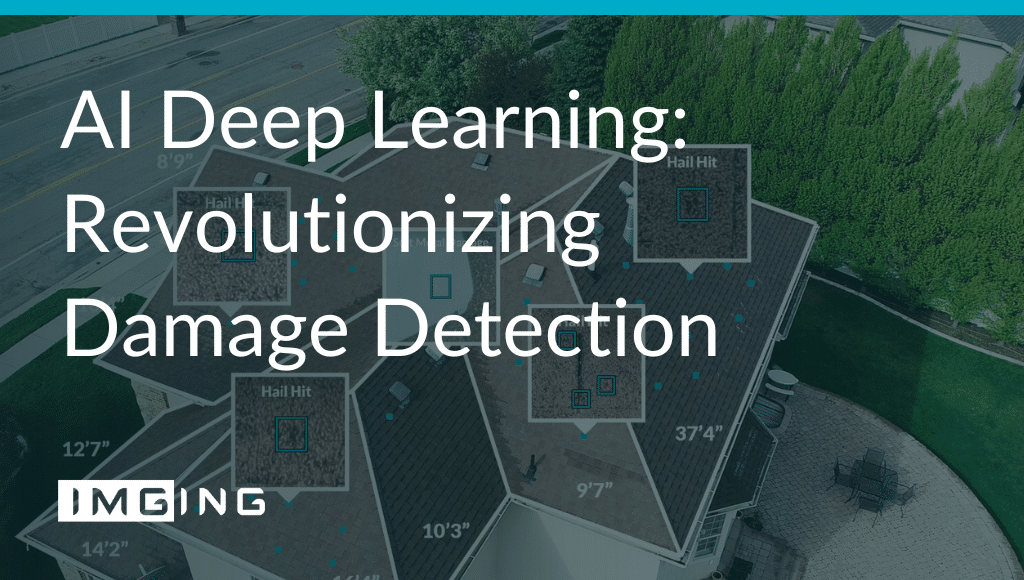

AI Deep Learning: Revolutionizing Damage Detection

Introduction Deep learning, a subset of artificial intelligence (AI), is predicated on the concept of emulating the layered structure and function of the human brain to interpret various forms of data. This approach allows machines to identify intricate patterns within images, text, sound, and more, facilitating nuanced insights and reliable predictions. Deep Learning is, more […]

Drone Imagery Vs. Aerial Imagery: Comparing Diverse Use Cases

In the landscape of modern data acquisition, drone imagery and aerial imagery have emerged as two distinct powerhouses or property data for P&C insurance carriers, each with its unique strengths and applications. While both methods contribute to the rich repository of property data, their deployment, attributes, and benefits vary significantly. This article delves into the […]

How Top Carriers Use AI to Boost Customer Experience [Updated August, 2023]

The claim settlement process is the pivot on which customer experience turns. Two main underpinnings support the importance of claim settlement. First, a claim is an opportunity for the carrier to fulfill its promise to a policyholder. Second, at no other point in the customer lifecycle are a policyholder’s expectations so high. The combination creates […]

IMGING Updates Now Available

Today we are excited to announce the first updates to IMGING in 2023. New features and improvements were introduced into the IMGING web app. These updates include: Historical Weather Data Intelligent Damage Detection Geometry Alignment in DXF Files Recently Viewed Jobs Current customers were emailed release notes today. The release notes explain and expand on […]

How Drone Inspections and AI Reduce Claims Reinspections

The insurance industry is always looking for ways to become more efficient and save money. One area where this is especially true is in the re-inspection claims process. But where do re-inspections occur and why can software-enabled drones slash re-inspections? Let’s review the claims process and highlight how to reduce re-inspections. Typical Insurance Claims Process […]

A Brief History ofAI in the P&C Insurance Industry

Artificial Intelligence (AI) looks different in every industry. In the auto industry, it looks like self-driving cars. In retail, it’s smart shelves, interactive kiosks, and smart signage. In manufacturing, it looks like intelligent machines that perform production processes and detect defects. But what does AI look like in the P&C insurance industry? Since there are […]

Xactimate Integration,Other UpdatesNow Available

The latest update to IMGING is now available to download from the App Store. This update includes a new integration, new features, several updates for improved user experience. Enjoy the 3.9 overview video below for a highlight of the newly-available features. Feedback Wanted To enable the Xactimate integration, contact your account executive. As always, reach out […]

Unlock Claim Inspection Speed and Accuracy with Loveland Innovations’ New Guidewire Marketplace App

SAN MATEO, Calif. & PLEASANT GROVE, Utah–(BUSINESS WIRE)–Guidewire (NYSE: GWRE) and Loveland Innovations announced that Loveland Innovations’ new Ready for Guidewire validated add-on is now available to ClaimCenter users in the Guidewire Marketplace. The claims experience can help build satisfaction and retain policyholders – if the process is efficient and claims are resolved quickly. Technology is a key driver in enabling insurers to […]

How Carriers are Finding Cost Efficiencies by Digitizing Insurance Claims

The latest numbers speak for themselves: the insurance industry can save over $6.7 billion every year by simply digitizing the claims process through the use of commercial drones. Just look around. Chalk, ladders and analog processes are disappearing from the landscape. Instead, more and more companies are letting drone-based technology solutions from companies such as […]

Here’s Why Drones Are Better for Roof Inspections

When it comes to maintaining your building’s structural integrity, consider your roof the first shield of protection. Still, even the most durable roofs are vulnerable to weaknesses. Over time, your roof may fall into disrepair due to leaks, aging and weathering, or storm damage, leaving everything sheltered beneath at risk. Regular roof inspections can help […]

Ease Adjuster Turnover with Drone Technology

Property claims continue to climb to record highs amid a rapidly expanding risk landscape, yet the insurance industry is struggling to retain its adjuster workforce. According to recent data from Deloitte, nearly 60 percent of carriers anticipated a higher topline, with much of the growth projected right here in P&C. With such a positive outlook […]

AI and Deep Learning: What Are They and Why Do They Matter to Insurance? [Updated August, 2021]

Insurance technology is leaping forward, and since we released IMGING’s ai-powered damage detection in 2018, we have seen big changes in how insurance companies handle everything from claims to underwriting and even fraud. Technology like automated inspection drones as well as data analytics technologies like artificial intelligence, machine learning and much-sought-after deep learning, have moved […]

Four Drone Deployment Strategies for Insurance Carriers

Drones In Insurance Claims Insurance carriers take a methodical approach to adopting new technologies that alter existing workflows. The COVID-19 pandemic is compressing traditional proof-of-concept trials and phased rollouts and accelerating digital adoption across the P & C insurance sector. The Federal Aviation Administration (FAA) introduced the Part 107 licensing program for commercial flying of drones in 2016. In the years since, the use of drones […]

Plan For the Future of Property Claims with Digitization and Machine Learning, Consolidation and Restructuring Claims Teams

As internal structural changes become the norm due to tightening budgets and the COVID-19 Pandemic, claims executives are looking for technology solutions that enable new operating workflows. These new workflows could include expanding desk adjusting teams, broadening field staff responsibilities to include desk adjusting, or streamlining how low and high severity claims are handled. Each of these improved workflows require technology solutions that advance the consistent and accurate gathering of claim data across your organization. Technology solutions don’t scale when inconsistency populates claim data sets. Because claim data can come from policyholders, independent adjusting firms, desk adjusting teams, or a carriers’ own field staff, it may have been collected using inconsistent […]

COUNTRY Financial® Partners with Loveland Innovations and Integrates IMGING® Technology into their Property Claims Process

Pleasant Grove, UT – COUNTRY Financial® has partnered with Loveland Innovations to centralize the collection and analysis of their property claim data in IMGING® and its proprietary AI-powered damage detection. By adopting IMGING’s inspection tools and data analysis capabilities, adjusters, analysts, auditors, and management can collaborate in one single source of property claims data. Through this partnership, Loveland Innovations will provide COUNTRY Financial’s property claims department with IMGING’s® AI-powered inspection platform and on-demand virtual inspection services. […]

COUNTRY Financial® Partners with Loveland Innovations and Integrates IMGING® Technology into their Property Claims Process

Pleasant Grove, UT – COUNTRY Financial® has partnered with Loveland Innovations to centralize the collection and analysis of their property claim data in IMGING® and its proprietary AI-powered damage detection. By adopting IMGING’s inspection tools and data analysis capabilities, adjusters, analysts, auditors, and management can collaborate in one single source of property claims data. Through this partnership, Loveland Innovations will provide COUNTRY Financial’s property claims department with IMGING’s® AI-powered inspection platform and on-demand virtual inspection services. […]

[Infographic] How IMGING Simplifies Drone Roof Inspections

After working with dozens of the top insurance carriers, solar installers, and roofing contractors, we’ve learned a thing or two about on-the-ground workflows for roof inspections with a drone. There are a plethora of drone apps for inspections, but only one IMGING inspection platform. When discussing IMGING as a platform, it’s often in relation to […]

5 Benefits of Outsourced Insurance Inspections During COVID-19

In the era of social distancing, insurance carriers are quickly changing how they handle high cost and time-intensive on-site property inspections. Property insurers began experimenting with AI, analytics, and drones a few years ago and have increasingly adopted this technology for adjusting property claims. After the FAA loosened the regulations on drones used commercially in […]

Guidewire Software Announces Loveland Innovations as New Solution Alliance Partner to Help Insurers Virtually Adjust Claims from Anywhere

PLEASANT GROVE, Utah and SAN MATEO, Calif. – Guidewire Software, Inc. (NYSE: GWRE), provider of the industry platform Property and Casualty (P&C) insurers rely upon, today announced that Loveland Innovations, a leading provider of data analytics and technology solutions for insurance, has joined Guidewire PartnerConnect as a Solution Partner. Founded in 2015, Loveland Innovations is […]

Why Carriers Should Think Beyond Manual Drone Flight

The drone market is exploding. IHS research predicts the professional drone market will maintain a compound annual growth rate of 77.1 percent through 2020. This is primarily driven by agriculture, energy, construction, and yes, insurance. Companies like State Farm, as well as Travelers, have already deployed drones in the insurance claims process for gathering imagery […]

What Carriers Get From Outsourced Inspections With IMGING

Outsourcing is one of the best ways to get more claim data, faster. While traditionally a method used following a large storm event, there is a compelling case that outsourcing most insurance claims inspections can improve processes and reduce LAE using the right tools. Desk adjusting has long been understood as a concept, but quality […]

Carriers: It’s Time to Think About Drone Strategy for Storm Season

Storm season is on the horizon, and it’s time for carriers to think about their claims strategies. As a recap, the 2019 Atlantic Hurricane Season had above average activity, most notable for devastating hurricanes Barry and Dorian. The Atlantic Hurricane Season wasn’t the only force of destruction in recent history. In fact, the previous decade […]

How Drone Technology Is Transforming the Insurance Industry

Though drone proliferation throughout the insurance sector might still be in its nascent stages, companies who have employed drones are moving away from hands-on, time-intensive methods, minimizing exposure to dicey work conditions, enhancing resource allocation, reducing fraud, and trimming core transaction processing. In fact, according to Deloitte, drone technology has the potential to help save […]

Preflight Planning Tips for Better Drone Inspections

Using an automated drone solution like IMGING decreases the time it takes to perform roof inspections, and with better flight planning, you can save even more time. Plan Your Flight in IMGING Begin by creating a new job in IMGING. This is where you will map the flight, schedule the job, and assign the job […]

MetLife Prepares for the Storms of Tomorrow With IMGING

Storm season is always demanding for insurance carriers. But 2017 was something unique. In August of that year, Hurricane Harvey formed in the Atlantic. Its power peaked as it made landfall in Southern Texas, displacing tens of thousands while leaving devastation in its wake. In the aftermath of one of the costliest tropical storms in […]

3 Reasons Why Carriers Trade Ladder Assist for IMGING On Demand

Economic instability, an unpredictable climate, increasingly strong storms, shifting customer expectations and fierce competition. The insurance industry is not immune to changing times, but it is ripe for innovation. Ever-evolving market needs require adaptation for survival and now more than ever, insurance companies are re-thinking claims strategies, technology implementation, how to increase productivity, and ways to […]

The Hanover Insurance Group to Leverage Loveland Innovations’ Drones, Technology to Enhance Claims Service

Pleasant Grove, UT, July 17, 2019 – Loveland Innovations, the leading provider of data analytics and technology solutions for insurance, today announced it will provide The Hanover Insurance Group with drone and technology capabilities, helping the company provide more effective and efficient claims service to its partners and customers. Through this partnership, Loveland Innovations […]

Considering Drones for Insurance Inspections? Here’s How to Find a Vendor

Drone technology is an effective tool for many industries. One that’s seeing a lot of success adding drones to their repertoire is insurance. Insurance has been one of the slower industries to innovate, but drones for insurance inspections are proving to be a productive way to reduce LAE, improve efficiency, and keep adjusters safer. Several […]

What Some Carriers Get Wrong About Digitizing Claims

While drones, AI, and other technologies promise to increase insurance carrier productivity, the changing customer, climate, and market means our industry needs a lot more than a few efficiency hacks. The insurance industry is facing increasingly powerful storms. Insured losses reached $79 billion last year. On top of that, Millennials now dominate our housing market. […]

Will The Digital Revolution Kill Ladder Assist?

As a growing number of insurers recognize the benefits of simplifying outdated claims processes – the days of ladder assist could be numbered. For years, third-party companies have determined loss. They have also uncovered the cause of damage for claims adjusters in the field. Such a service, while useful, does not solve a few fundamental […]

Loveland Innovations Enhances Claim Adjuster Safety, Efficiency for Western Reserve Group

Pleasant Grove, Utah, April 2, 2019 (Newswire) –Loveland Innovations®, maker of advanced data gathering and AI analysis solutions, announced that it will provide its drone-based inspection platform, IMGING®, to Western Reserve Group, one of Ohio and Indiana’s leading property and casualty insurance carriers. “For the majority of claims, there’s no reason why an adjuster needs to […]

IMGING Becomes First Drone Platform With On-Site Roof Measurements, Adds AI Damage Detection for Commercial Roofs

New IMGING app updates bring innovative possibilities for claims adjusting and roofing PLEASANT GROVE, Utah, March 27, 2019 – Loveland Innovations, maker of advanced data gathering and AI analysis solutions, added ground-breaking enhancements to its inspection platform, IMGING®. These enhancements include drone-based on-site measurements, AI and deep learning-powered damage detection for commercial roofs, and other powerful […]

Two Ways to Reduce LAE With Drone Solutions

Innovative insurance leaders look for technologies that improve efficiencies and give policyholders the excellent service they deserve. Perhaps the hottest solutions on the market today use drones to capture data and streamline insurance workflows. Many carriers are looking to drone technology for benefits that range from gains in productivity to more consistent data capture, better […]

Are One-Click Settlements on the Horizon?

Customer satisfaction is an essential part of any successful company but insurance carriers in particular have a lot to contend with. Claims are stressful events for policyholders and carriers must deliver results fast or their customers will start eying the competition. To settle claims faster, many carriers are relying on insurance claims automation. As Jim […]

Case Study: How 3 Carriers Are Using IMGING to Redefine Claims

Carriers use IMGING to streamline roof claims with automated flight, measurements, 3D models, ultra-high-res imagery, and AI-powered damage detection. IMGING lets adjusters safely and consistently inspect any roof in just a few minutes, while helping carriers reduce cycle times, prevent re-inspections, and lower loss adjustment expenses. Curious about their specific results? Read the full story […]

How Drones Can Give You Way More Than Hail Damage Pictures

For a long time, adjusters have used ladders and a digital camera to gather imagery of hail and other damage. This takes a long time and, in some cases, excessive damage and precarious roofs can prevent an adjuster from getting on the roof and getting the pictures they need to process a claim process. These […]

No Longer a Fad: Why Insurance Adjusters Need Drones

The insurance industry is experiencing big changes for the first time in a long time. As technology evolves and customer demands and expectations change, professionals in all industries need to adapt or get left behind. For insurance adjusters, drones are the next great way to make customers happy. Drones aren’t just a cool alternative to […]

How Will UAV-Based CAT Response Change After Hurricane Florence?

The brunt of the wrath from Hurricane Florence might have passed, but as the storms start to settle for residents of the Carolinas, they’re just beginning for CAT responders. Global risk modeling firm RMS estimates insured losses for wind damages to be between $1.3 billion and $2.6 billion and between $700 million and $1.2 billion […]

A Detailed Look at How Drone Solutions Reduce Loss Adjustment Expenses

The insurance industry takes a meticulous approach to innovation and insurers only consider the most viable new technologies for adoption. Led by a handful of forward-thinking carriers, the industry has been using and testing drone solutions to see whether they can improve accuracy and speed, or even provide alternative workflows that can streamline claims. Drones […]

Beyond Adjusting: How Drone Tech Improves the Customer Experience

More often than not, hurricanes do a lot of damage – sometimes enough to displace people from their homes. This means homeowners need their claims adjusted as soon as possible so they can get back to living life as usual. Providing a good experience after a scary event is a crucial time for building trust […]

Insurers: Here’s How Drone Tech Can Help You Prepare for Hurricanes

We’re most of the way through June and well into hurricane season – it’s a hectic time for insurance carriers and their customers. Last year, Hurricane Harvey did billions of dollars in property damage. While hurricanes are never a good thing, it’s important for insurers to prepare an effective catastrophe response so they’re prepared for […]

Why Many Insurance Adjusters Are Trading in Their Ladders for Drones

Regardless of the industry, people want to get more done or to arrive at a conclusion as quickly as possible. Luckily for insurance adjusters, drones offer a way to get more done than more traditional ladder methods. Reports suggest that drone usage will make claims adjusters’ workflow 40-50% more efficient in the future, but they’re […]

6 Ways A.I. is Changing the Face of Insurance

The concept of Artificial Intelligence (A.I.) was once just science fiction. But these days, A.I. lives in everything from your smartphone to your refrigerator, and it’s already changing the insurance space in big ways. There are varying approaches to A.I. (see our article on A.I., machine learning, and deep learning), and many of these approaches […]

How to Spot a True Insurance Drone Solution

There are many ways insurance professionals can start using drones for things like roof and property inspections. They can go grab a drone off the shelf and learn to fly and capture images manually, but a more popular route is to find a drone solution that takes care of some of the tough work by […]

From 1 to 1000: How to Scale a Drone Inspection Solution (Part 2)

In our last post, we offered some advice on how to choose a drone inspection solution that’s scalable. In this post, we’ll look at how to take the solution you’ve selected and get it in the hands of hundreds –even thousands of users, quickly and effectively. A successful drone rollout plan will take a […]

From 1 to 1000: How to Scale a Drone Inspection Solution (Part 1)

There are currently hundreds of thousands of open insurance claims due to hurricanes in Texas and Florida. Field adjusters, underwriters, contractors and insurance pros at all levels are working to the bone to get people’s homes (and lives) back together. Any time large natural disasters like these happen, thousands of people are stretched to their […]

Four Big Things Harvey Taught Us About Drone Tech for Insurance

15 years from now, the commercial drone industry will look back at Hurricane Harvey, as well as the subsequent hurricanes like Irma and Maria, as landmark events for drones. The use of drones to speed up insurance workflows has been the buzz for quite some time now, but Hurricane Harvey is the first catastrophic event […]

Ladder Assist or Drones? Which Can You Lean on for CAT Response? – Lessons Learned from Harvey

“Are you guys drone pilots?” We were packing our car for another day of flights in the Rockport and Port Aransas area. It was dark out, about 6:00 AM and Leif, our CTO and I were anxious to get on the road when we heard the voice behind us ask us if we were drone […]

Towns Slowly Recovering After Harvey

As we drove along the streets of damaged parts of Texas, in some ways we felt like we were in a war zone: damage along every road and a feeling of tension and uncertainty in the air as many homeowners wondered and worried about the future of their homes and community. As mentioned in previous […]

The Aftermath of Harvey

It’s hard to express what this past week has been like for our team in Texas. We’ve worked alongside top-notch insurance professionals, met gracious and patient home owners and have witnessed scenes of devastation and examples of great resilience at the same time. It’s hard to keep up with documenting what we’ve done, seen and […]

#DroneRideAlong Day 1: Flying in the Fray

We made it to Texas safely, and we’re on the ground, ready to help. We arrived in Houston and our work took us south. As we travelled we noticed the most pronounced type of damage on rooftops was caused by the powerful wind Hurricane Harvey brought with it. We saw sparse wind damage in Bay […]

The Loveland Innovations CAT Response Team is Headed to Harvey

In 1992, members of our team (then working at another Insurtech company) were invited to accompany a large insurance carrier to observe and help in the aftermath of Hurricane Iniki on the island of Kauai. They witnessed the devastation first hand and felt the urgency of victims scrambling to get their lives back together, which […]

New Partnerships, New Tech, and Serious Steps Forward for Insurance

We’ve been turning and burning the last few weeks and have made some absolutely killer steps forward. Here’s just a peak at what you’ve missed over the last few weeks. Partnership with Drones Software Canada Drone tech, eh? Our partnership with Drone Software Canada Inc. gives them exclusive rights to deliver our software to […]

Loveland Innovations Awarded a Second Patent for Ground-Breaking Drone Tech

New patent improves how aerial imagery can be used in capturing, identifying and estimating roof damage ALPINE, Utah – August 30, 2017 – Loveland Innovations®, maker of advanced drone solutions for the Property and Casualty Insurance Industry, announced today that the U.S. Patent and Trademark Office has awarded it a second patent. The new patent […]

Feet on the Street and Drones in the Sky

Drones are all the buzz in the news right now and there’s an arms race to get them in the hands of insurance pros. After much market curiosity and anticipation to see just how drones shake up the P&C industry, Crawford & Company demoed their drone services offering last week to a select group of […]

Next Time Your Roof Gets Hit by Hail, a Drone May Inspect Damage

This is taken from an article written by Bill Hanna for the Star-Telegram. You can view the original article here. DENTON – When Pam Wilson got a recent call asking if her insurance company could use a drone to inspect her hail-damaged roof, she didn’t hesitate to say yes. “I thought it was pretty cool […]