In the landscape of modern data acquisition, drone imagery and aerial imagery have emerged as two distinct powerhouses or property data for P&C insurance carriers, each with its unique strengths and applications. While both methods contribute to the rich repository of property data, their deployment, attributes, and benefits vary significantly. This article delves into the nuances of drone and aerial imagery, comparing and contrasting their use cases, with a specific focus on their significance in the insurance sector for claims executives.

Aerial Imagery: A Panoramic Overview

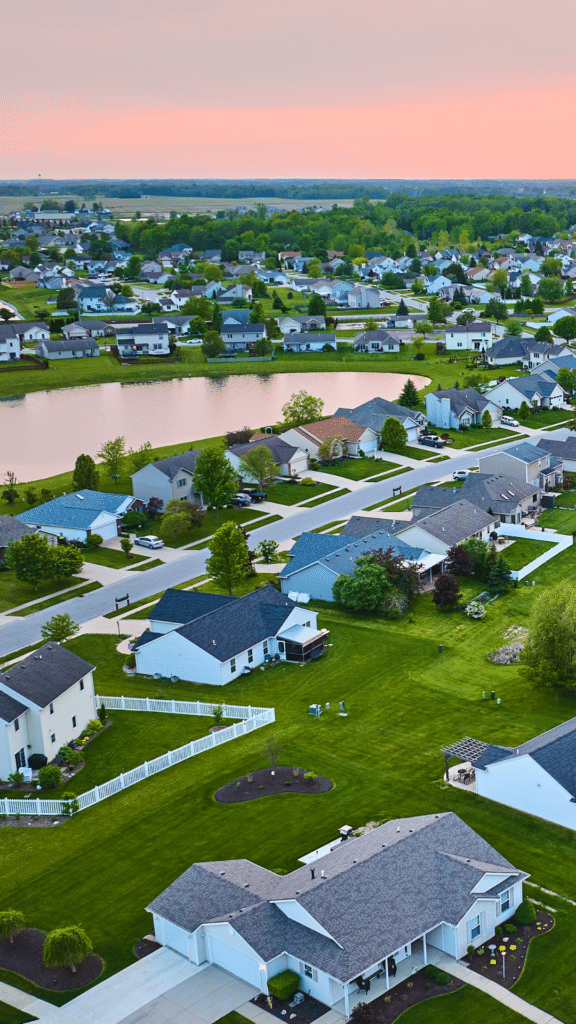

Aerial imagery, captured from low-altitude airplanes, has long been a staple in various industries, including urban planning, agriculture, and environmental assessment. This method involves capturing images of large geographical areas, providing a bird’s-eye view of landscapes and properties. These images are then subjected to preprocessing, often involving stitching multiple images together to create a seamless mosaic. However, this method comes with inherent limitations:

- Dated Information: Aerial imagery can suffer from obsolescence. The time lag between capture and preprocessing can render the data outdated, limiting its usability for real-time applications.

- Limited Precision: Due to the higher altitude at which airplanes fly, the resolution and detail of aerial images will struggle to match the requirements needed for precise inspections and assessments.

Pre-inspection aerial imagery does offer benefits as well. Insurers can gain a head start in understanding property conditions before an event, narrowing the outcomes possible after a thorough inspection. Let’s review in greater detail the benefits of aerial imagery:

- Aerial Measurement Pre-Processing: By possessing accurate measurements beforehand, the inspection process gains efficiency, enabling inspectors to focus on nuanced aspects and potential issues not seen from an aerial view. This advantage is particularly potent in time-sensitive scenarios, such as claims assessments after natural disasters, where speed trumps precise evaluations, and the severity of damage is broadly known.

- Dated Information: This is both a limitation (see above) and a benefit as it allows insurers to peer into the past to glean insights about a property’s condition before any damage or incidents occurred. This historical perspective provides a baseline understanding of the property’s state, enabling claims adjusters to discern existing conditions and potential vulnerabilities.

Drone Imagery: Onsite Precision and Real-time Insights

In contrast, drone imagery has revolutionized data collection by bringing technology to property claims. Drones, or unmanned aerial vehicles (UAVs), equipped with high-resolution cameras, are deployed directly at the claim site and flown by an FAA-certified pilot or claims adjuster, providing a level of precision and immediacy that aerial imagery struggles to achieve. The key differentiator lies in the following factors:

- Near Real-time Data: Drone imagery offers the advantage of near real-time data acquisition. Inspections and assessments can be conducted promptly, allowing for quick decision-making and responsive actions when deployed strategically or universally.

- Enhanced Precision: Drones can operate at lower altitudes – mere feet above the property in question – capturing images with exceptional detail. This precision is especially valuable for tasks such as damage assessment and condition analysis. When higher-resolution imagery is used for training AI, better models are built, and outputs are improved.

- Flexibility: Drones can navigate complex and hard-to-reach areas, providing comprehensive coverage even in challenging environments. This adaptability is crucial for tasks like claims drone inspections after damaging weather.

Use Case Comparison: Insurance Industry Perspective

In the insurance sector, both drone and aerial imagery play pivotal roles, albeit with differing scopes and impacts. Understanding their specific applications can shed light on their complementary roles:

- High-value Underwriting: Aerial imagery finds its niche in large-scale risk assessment for underwriting purposes. It offers an overarching view of properties, aiding insurers in evaluating broader risk factors like location and surrounding environment.

- Claims Inspections: Herein lies the area where drone imagery truly shines. Claims inspections require granular insights into property conditions, which is precisely where drones excel. By providing near real-time data with detailed imagery, drones streamline the claims process, enabling insurers to promptly assess damages and expedite settlements.

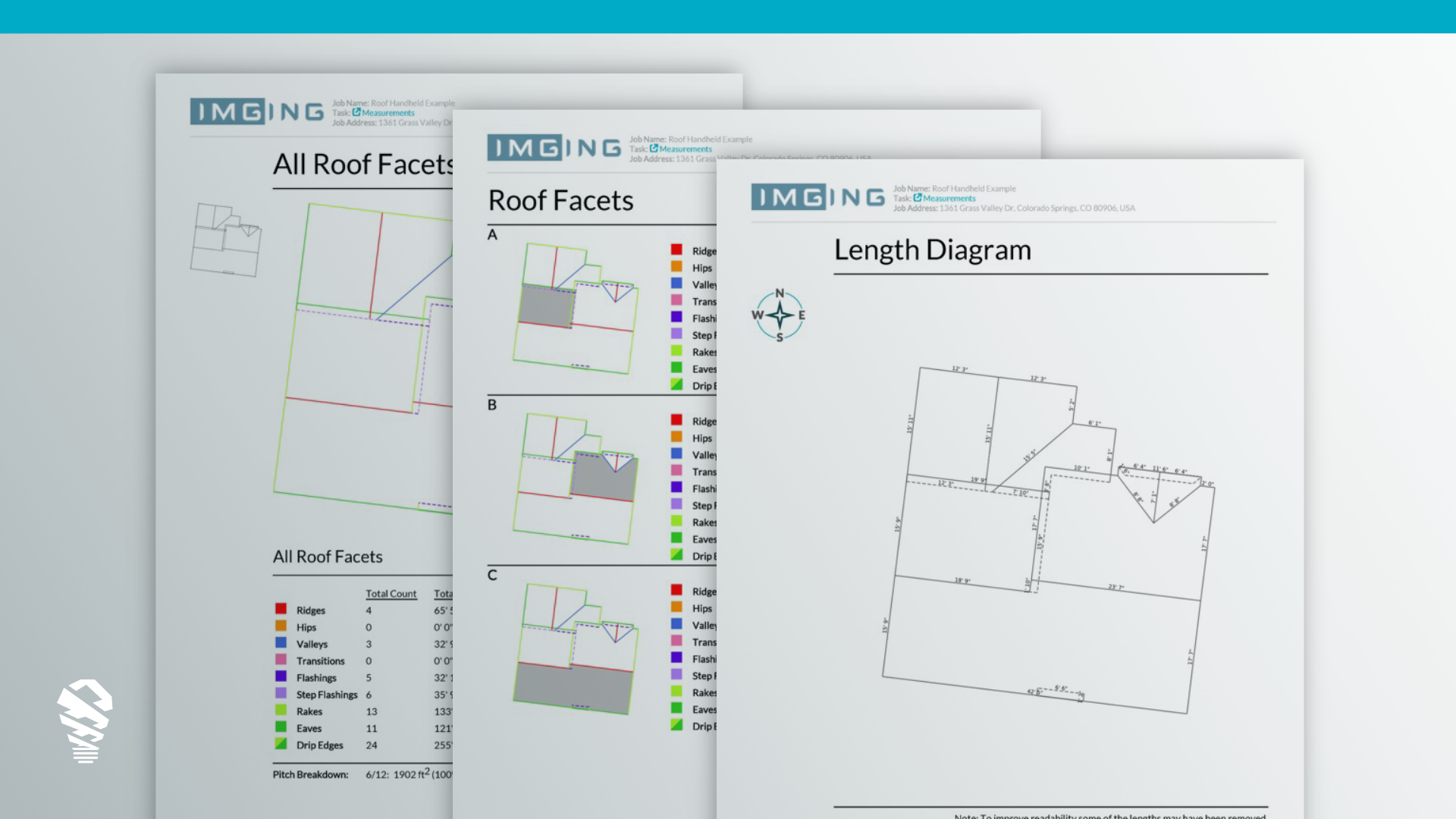

- On-site Data Processing: A standout feature of drone imagery is the capability for on-site data processing. Advanced technologies like AI-based damage detection and computer vision enable immediate analysis of captured images. This empowers inspectors to detect damage swiftly and accurately, facilitating quicker claims processing. Additionally, computer vision techniques aid in acquiring measurements where aerial imagery isn’t available due to coverage issues, because the property has undergone an addition, or it is newly constructed.

- Environmental Considerations: When it comes to the environmental impact of data acquisition, the contrast between drone imagery and traditional aerial methods is stark. Drones, with their smaller ecological footprint and reduced emissions, stand as an eco-conscious alternative. In an era where sustainability is gaining traction and investors demand green approaches to business, opting for drones aligns with the growing emphasis on minimizing environmental impact. By embracing drone roof inspections, insurers not only streamline their operations but also contribute to a greener future.

- Drone Roof Measurements: Almost always the ultimate decision on claim settlements requires on-site evaluation, making on-site drone roof measurements a practical choice for an insurance claims workflow. This flexible approach not only expedites claims processing by setting the stage for on-site settlement, improves the customer experience by shortening cycle times, and also reduces LAE.

Balancing Act: The Optimal Approach

As the insurance industry seeks to strike a balance between broad risk evaluation and precise claims processing, the synergistic use of both drone and aerial imagery emerges as an optimal approach. Aerial imagery can set the stage by providing a macroscopic overview of properties, before stepping on site, thereby facilitating initial risk assessment. Subsequently, drones can step in to deliver on-the-ground insights, ensuring accurate and prompt claims inspections. This often comes down to a preferred workflow for the insurer.

In evaluating the optimal approach for carriers, a series of crucial questions emerges to illuminate the path forward:

- Striking the Pre-Site Balance: Is the capability for on-site settlement crucial, and to what extent should an adjuster be equipped with insights into the property’s previous condition before arriving on-site?

- Navigating the Policyholder Journey: A potential trade-off arises, centered around the policyholders’ experience during this critical phase. Often fraught with uncertainty and apprehension, this juncture demands careful consideration. Offering on-site inspections complemented by transparent reports, such as those harnessed from drone technology, can foster trust and reassurance among policyholders during times of distress.

- Weighing the Cost-Benefit Equation: In the process of deliberating the intricacies of pre-site inspections, measurements, and the on-site encounter, a thorough analysis of costs and benefits is imperative. Striving for the optimal equilibrium demands a nuanced understanding of which strategy aligns best with the carrier’s overarching goals and values.

The landscape of claims assessment presents multifaceted dimensions, where the interplay between pre-site knowledge and on-site experience forms a pivotal crossroads. To successfully navigate this juncture, each carrier first needs to decide where their priorities and then embark on a trajectory that not only optimizes their operations but also upholds their commitment to policyholders during their times of need.

Conclusion: Merging Precision and Perspective

In the evolving landscape of data-driven decision-making, the marriage of drone and aerial imagery offers a comprehensive solution to the diverse needs of the insurance sector. Aerial imagery provides the perspective of a strategist, while drone imagery assumes the role of a meticulous inspector. By leveraging the strengths of both methods, insurers can harness the power of precision and perspective to navigate the intricacies of risk assessment and claims management with unparalleled efficacy.