The claim settlement process is the pivot on which customer experience turns. Two main underpinnings support the importance of claim settlement. First, a claim is an opportunity for the carrier to fulfill its promise to a policyholder. Second, at no other point in the customer lifecycle are a policyholder’s expectations so high.

The combination creates a critical point in carrier operations. If a carrier handles the claim settlement process well, they have created a loyal customer and a net promoter. But a dissatisfied claimant will likely shop for another carrier and may take their friends and neighbors with them. According to one customer satisfaction report, fewer than half of the dissatisfied claimants polled would recommend their insurer, and 10 percent have already switched carriers.

Today’s insurance carriers have an opportunity to create a competitive advantage not only in customer experience, but also in claims handling, loss adjustment expense, and even underwriting practices. Artificial intelligence (AI) for insurance promises solutions to some of the industry’s most pressing pain points. Forward-thinking carriers are already reaping the benefits.

Catastrophes and Artificial Intelligence Insurance Solutions

In P&C insurance, where customer satisfaction and reputation form the cornerstone of business, an interesting pattern emerges. The majority of insurers have managed to navigate the claim process with commendable finesse, as evidenced by the ascending customer satisfaction rates for claims handling, a trend echoed in JD Power surveys over successive years. Nonetheless, there are pockets across the nation where these scores plummet, casting a spotlight on a critical issue. Florida and Texas, states often besieged by the ravages of hurricanes, find themselves grappling with below-average satisfaction ratings, a stark reminder of the unique challenges catastrophe claims pose. Recent headlines about major insurers discontinuing coverage in California and offloading more policies in Florida are current evidence of these trends. But with California, Texas, and Florida constituting the three most populous states with more than 36% of the nation’s population means that carriers need to develop effective strategies to underwrite in these states while simultaneously lowering LAE.

In light of these dynamics, one fact becomes clear – addressing catastrophe claims handling is paramount if carriers aspire to maintain high customer experience ratings across all markets and in keeping LAE as low as possible. Therefore the prowess of AI and drone solutions takes center stage. This transformative technology not only enables carriers to swiftly scale up to meet the demands of catastrophes but also equips adjusters with a treasure trove of swift and dependable data on damages. The discerning eyes of top carriers have already fixed upon this potential. AI and drones leaped into action during the aftermath of Hurricane Florence, a testament to their effectiveness. In the face of perilous conditions that deterred adjusters from entering flood-ravaged areas, drones soared, capturing essential imagery and data. This critical information was relayed to adjusters, facilitating claims review and settlement before needing to set foot in the heart of the catastrophe zone.

Claims Processing Time and New Customer Expectations

One of the most compelling stories involving claims and artificial intelligence insurance solutions involves the startup Lemonade. The company made headlines when settling a 2017 claim in three seconds. The policyholder filed the claim after losing his winter coat. Lemonade’s AI bot analyzed the information, determined there was coverage, found no fraud indicators, and paid the claim.

The story may sound like a marketing stunt, but it raises the question: If Lemonade can settle a claim for a coat in three seconds, what are the implications for other carriers?

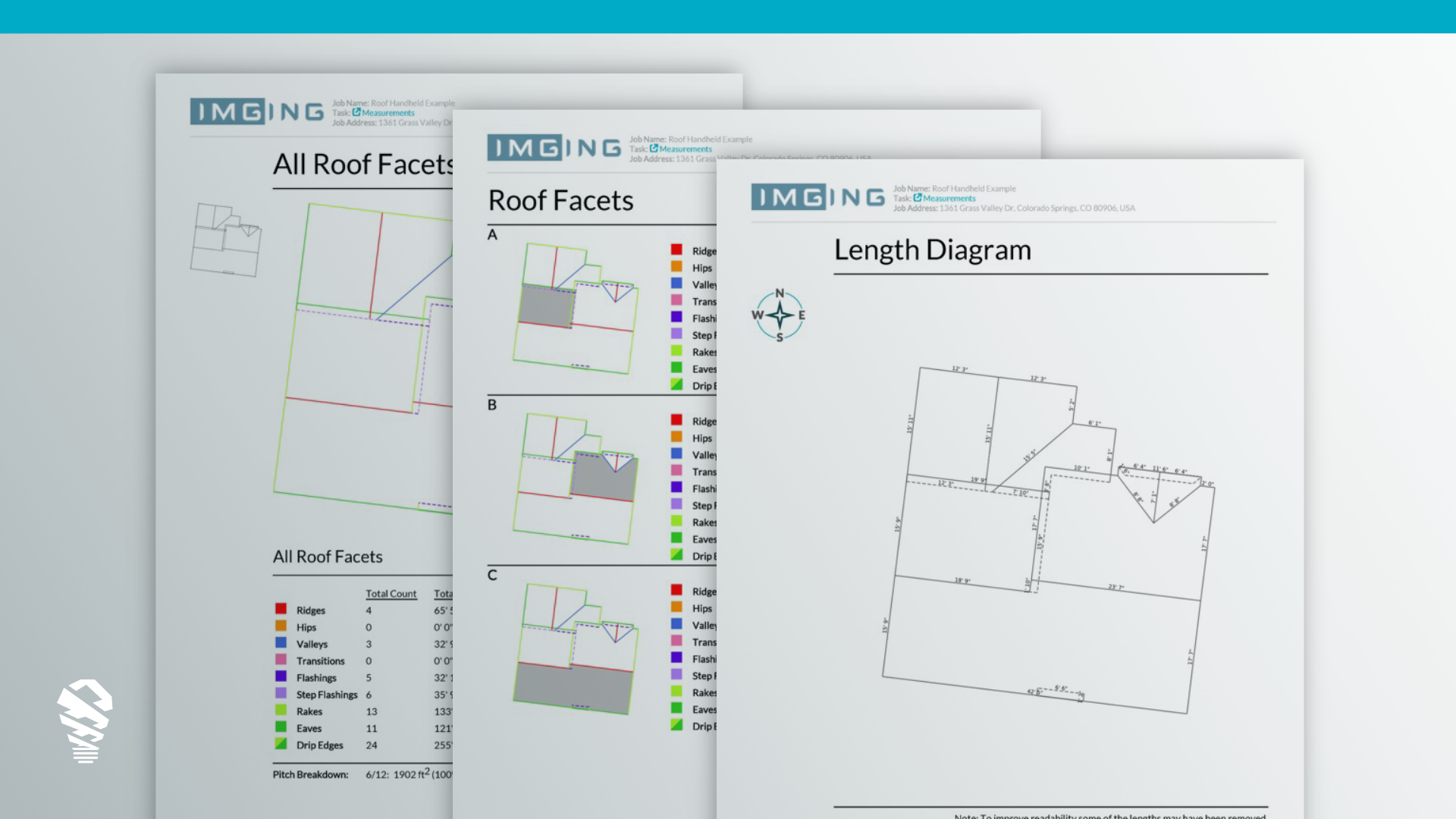

The growing abilities of AI coupled with increasing customer expectations mean it makes sense for carriers to embrace technology-driven solutions. Currently, most major carriers can’t create Lemonade-like instant settlements, but there is potential. Settling a roof claim, for example, may take the unaided adjuster weeks or months, but with the use of AI-powered inspection platforms, carriers can turn around a fully adjusted claim in a few days. For those who employ the technology, AI delivers a triple competitive advantage – more efficient claims handling, lower loss adjustment expenses, and improved customer experience.

Predicting Losses and Setting Reserves

Among artificial intelligence insurance programs, predictive data analytics is also making a wave among the major carriers. Accurate loss prediction helps carriers sharpen underwriting and set appropriate reserves. A study by A.M. Best asserts carriers who use predictive data analytics to help form risk management strategies are more competitive than those who don’t. Further, the report notes carriers who don’t embrace the technology will suffer in the coming insurance market. As the landscape of insurance navigates profound shifts, predictive data analytics assumes a pivotal role in shaping the destiny of carriers, not merely as a competitive edge but as an imperative for resilience in a swiftly changing industry landscape.

Claims-Focused AI Strategies

Artificial intelligence insurance technology has the promise to deliver efficiency and savings across carrier operations. However, focusing AI directly on the claims process with chatbots, drone solutions, and inspection platforms may be the most impactful approach. Claims handling has the greatest impact on customer experience, and it is the customer experience that matters most to a carrier’s bottom line. While the potential of AI spans multiple aspects, the financial reverberations of efficient claims operations outshine even the innovative power of chatbots and language models. Claims handling stands as the pinnacle, influencing not just operational efficiency but also carrying the potential to elevate customer satisfaction, which directly translates to a stronger and more resilient bottom line for carriers.

Common Misconceptions of A.I in Insurance

As the insurance landscape embraces the transformative potential of AI, a few persistent misconceptions are still lingering. Let’s dive into these to debunk these myths and shed light on how AI not only enriches but also enhances various facets of the insurance sector.

One common misconception surrounding artificial intelligence in the insurance sector is that its integration disrupts the role of human professionals. In reality, AI technologies like predictive data analytics and automated claims processes are designed to complement human expertise, not replace it. AI empowers claims adjusters with invaluable data-driven insights, enabling them to make well-informed decisions more efficiently. This symbiotic relationship enhances their ability to accurately assess risks, evaluate damages, and provide comprehensive solutions to policyholders. Rather than rendering human involvement obsolete, AI amplifies the capabilities of professionals, elevating their role in delivering exceptional customer experiences. For more on this topic, refer to this article.

Another misconception often encountered is that AI is merely a buzzword without tangible benefits. However, this perception stands in stark contrast to the reality witnessed by the insurance industry. For instance, predictive data analytics powered by AI have proven their value, enabling carriers to make more accurate predictions about potential losses and tailor their underwriting practices accordingly. A.M. Best’s study has highlighted that carriers leveraging predictive data analytics gain a competitive edge over those who do not. However the full impact of AI to the combined ratio may not be unveiled for years or may never be known. It is fair to say that the the macro-impact of AI across a P&C carrier is still to be determined.

Conclusion

Within the complex tapestry of insurance, the claim settlement process emerges as the point upon which customer experience pivots. This pivot is underpinned by two defining pillars. First, a claim represents an opportunity for carriers to fulfill their promise to policyholders, a pivotal juncture that underscores trust and assurance. Second, at no other point in the customer lifecycle do expectations soar as high as they do during the claim settlement. This fusion creates a point of inflection within carrier operations with far-reaching implications.

Mastering the art of claim settlement can be a transformative stride. It can create loyal customers and fervent advocates, sculpting a carrier’s standing in the industry. Yet, a dissatisfied claimant can wield equal influence, potentially steering customers away and prompting them to take their social circles along. A customer satisfaction report sounds a cautionary note – fewer than half of dissatisfied claimants are inclined to recommend their insurer, and an astonishing 10 percent have already switched carriers.

Today’s insurance landscape is a canvas of unprecedented opportunity, offering carriers a competitive advantage not only in customer experience but also in claims handling, loss adjustment expenses, and underwriting practices. The realm of AI for insurance holds the promise to address some of the industry’s most entrenched pain points. Pioneering carriers, propelled by foresight, are already reaping the rewards of their technological embrace.

Loveland Innovations turns roof and property data into actionable information for carriers. Interested in learning what AI can do for you? Request a demo.