Artificial Intelligence (AI) looks different in every industry. In the auto industry, it looks like self-driving cars. In retail, it’s smart shelves, interactive kiosks, and smart signage. In manufacturing, it looks like intelligent machines that perform production processes and detect defects.

But what does AI look like in the P&C insurance industry?

Since there are so many different facets of the insurance industry—claims, underwriting, fraud prevention, customer experience, etc.—AI takes on several different roles. To understand how AI entered and transformed the insurance landscape, let’s look back at the history of how AI technologies emerged.

But before we do, let’s define what we mean by “artificial intelligence”:

What is Artificial Intelligence?

AI is a field that uses computers, machines, and datasets to mimic the problem-solving and decision-making capabilities of humans. Essentially, AI is a computer that thinks and acts like a person – including the ability to ‘learn’ and become more accurate.

Approaches to AI

There are a lot of different subsets under the AI umbrella. We’ll discuss a few of these well-known subsets.

Machine Learning

This is a type of AI that can actually “learn.” The more data it gets, the smarter it gets. The computer program gets better at problem solving and decision making as it gathers more information, however it needs to be programmed to know what features to use and look for.

Deep Learning

Deep learning is a subset of machine learning and a type of AI dependent on multi-layered neural networks to learn. It needs large data sets, and once provided the computer system allows the computer to make decisions about other data. This type of AI gives the computer the power to interpret patterns and predict outcomes as it learns what features are important in making a decision.

Cognitive Computing

Cognitive computing uses computerized models to mimic the human thought process in complex situations. Think a software system troubleshooting IT issues to narrow down the problem.

Now that we have defined the different forms of AI, we can talk about how this technology is changing the face of claims, underwriting, fraud detection, and customer experience.

Pattern Recognition

Not all deployments of AI are created equal. For example, pattern recognition is a rudimentary form of artificial intelligence sometimes marketed as damage detection. For example, simple AI that reviews data sets and looks for patterns can be deployed in the P&C insurance agency. One example is inspecting property materials for damage. When anomalies are detected, it can flag these anomalies. Let’s a pattern recognition neural network is analyzing asphalt shingles. Once it finds something different than what it expects (more asphalt singles) it will flag it. This is fundamentally not damage detection and not the method Loveland Innovations employs.

Pattern recognition has many weaknesses. It’s common for a pattern recognition system to highlight every anomaly it finds, and accuracy suffers tremendously. The result can be overwhelming a pattern recognition-trained system returns more anomalies than can be reviewed.

AI in P&C Insurance Industry

1950s – The Origins of AI

Artificial Intelligence first came on the scene in the 1950s. As you can imagine, AI looked a lot different than it does today. In 1950, AI was just a computer program that could play chess. Obviously, that type of computer intelligence isn’t very useful for insurers, so let’s move to the next phase of AI development.

1980s – The Beginning of Machine Learning

The development and proliferation of machine learning began to attract interest in its commercial applications by financial services companies, including insurance. The first application of machine learning was in the underwriting process.

Since machine modeling is specifically designed to extract valuable information and make predictions, this technology crept into insurance with the introduction of demand modeling for insurance carriers.

2010s – The Introduction of Deep Learning

This is when AI applications for P&C insurance carriers began to take off.

Underwriting

For our seasoned insurance agents, you remember the days of broad actuarial tables that assigned policy seekers into large groups based on their risk category. But with deep learning, insurance agencies can gather data from more sources and devices to more precisely define risk groupings, allowing for more competitive product offerings and pricing. This is also possible due to the proliferation of software through carrier processes, creating a rich set of digital data for analysis.

Fraud

With an estimated $30 billion lost to insurance fraud in the US every year, it’s important that insurers protect against fraud that can drag down their combined ratio. The best way to do that is to detect and prevent fraud. Deep learning allows insurance carriers to easily analyze data gathered from previous claims, customer information, social media, etc., to build predictive models that can identify, score, and prioritize possible fraud.

Customer Service

The use of AI in customer service often goes unnoticed but has been present in the customer service operations of insurance carriers for years. AI is deployed in the use of chatbots to answer online customer service inquiries, to measure the sentiment of online discussions, and to manage large data sets.

Predictive Weather Forecasting

Traditional weather forecasting still exists, but some insurance carriers have begun exploring AI in predictive weather forecasting. If they can plan for claims in areas before they happen, their customer service, claim adjusters, and repair response can be improved. The federal government has endorsed this approach with the National Oceanic and Atmospheric Administration (NOAA) sponsoring studies validating these methods.

2017 – Property Inspections

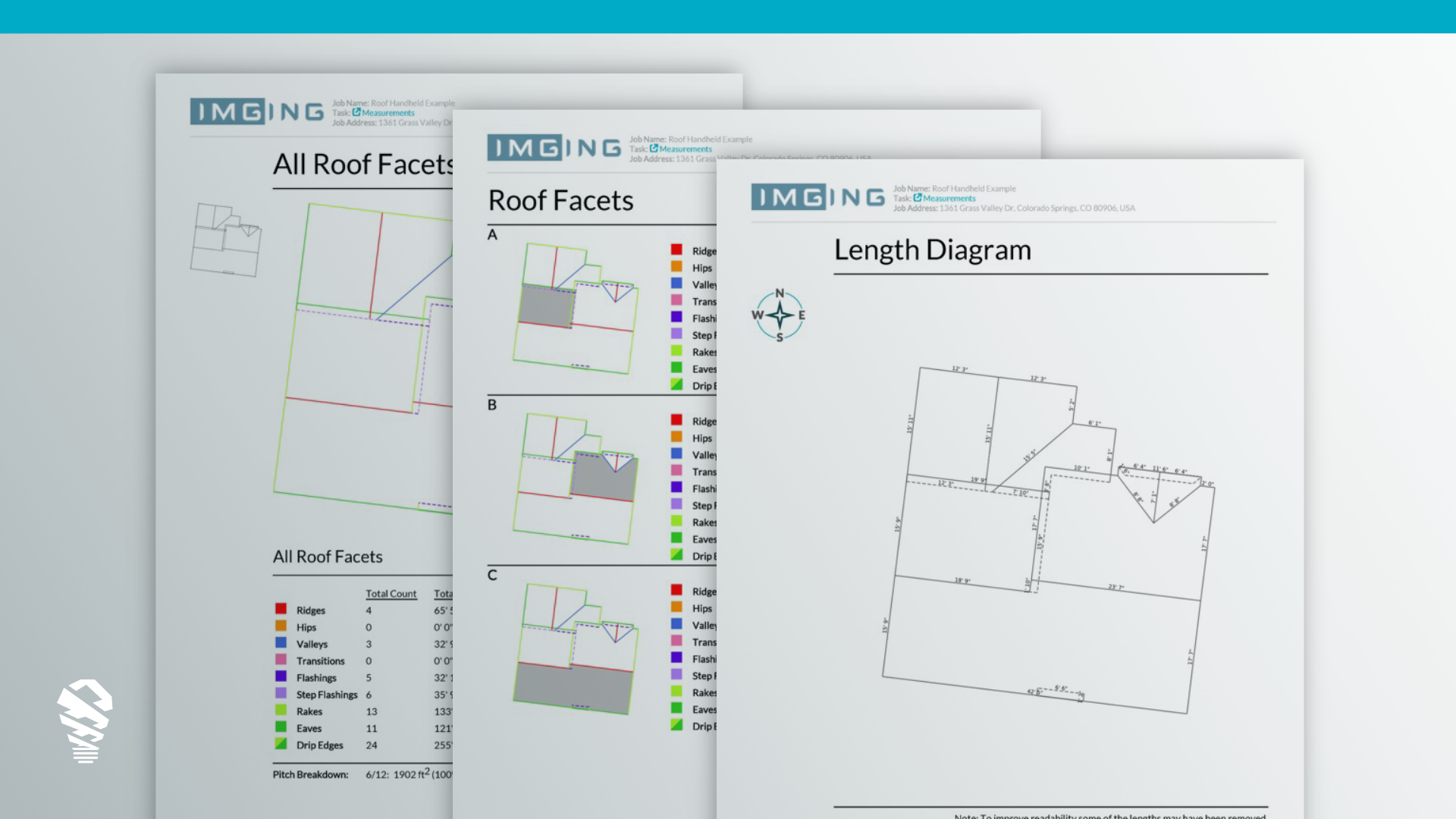

While drones can be used in the underwriting process, they’re more impactful when collecting claim data. A property insurance claim is often a traumatic and unfamiliar event for the property owner. This setting creates a perfect inflection point for the customer to have an incredible or poor experience, and then make lifelong customer loyalty decisions as a result. Augmenting personnel’s opinions with robust data aided by AI adds to the certainty of claims decisions, as well as validating the logic along the way.

Computer vision also changes how insurers assess risk. With the use of drones (that won’t become available until 2013), insurers can take aerial images of a property, then use those images to create 3-D models, check for damage, take measurements, etc.

Claims + Drones

Wind and hail roof claims are the most common property insurance claim, making up about 45% of all property claims in the U.S. Drones, also known as Unmanned Aerial Vehicles (UAV), make the claim data collection process faster, safer, and more consistent. Insurance adjusters no longer have to climb onto a claimant’s roof to make measurements and take pictures; they can pilot a drone safely from the ground and get more reliable data than if they were manually gathering the information. That’s why drones and AI form such a potent pair in lowering LAE while adjusting with more accuracy.

While drones are simply involved in the data collection, they provide a unique real-time view of the roof and property that cannot be captured otherwise. The quality, perspective, and resolution of these images make them a perfect case for AI analysis. Once the drone has gathered the necessary data, the information is sent to the cloud and insurers can employ deep learning technology to effectively organize and analyze the data. This process ensures that all information is standardized and stored in the same place, improving cycle times and lowering LAE.

This is how Leif Larson, CTO of Loveland Innovations, explains how IMGING combines these two forms of AI to improve property inspections:

“The deep learning framework used in IMGING Detect is foundational technology we’ve built to provide a visionary toolset to anyone who does inspections. We’ll give IMGING the ability to find multiple kinds of damage, to analyze property risks, determine materials, detect objects, and make the process of building and property inspections much more streamlined.

Since AI was introduced to property inspections through IMGING, insurance carriers have analyzed nearly 100,000 property claims using artificial intelligence. Its purpose is to make the adjuster more efficient and aid in their decision making process – not replace them in the complex world of claims adjusting.

Conclusion

Carriers use a profitability metric known as the combined ratio, where the combined ratio = incurred losses + expenses/ earned premiums. The AI arms race is heating up as carriers search for an edge after a difficult 2021. With climate changes creating less certainty than ever before, carriers are adopting AI at an increased rate across their business functions, making this an interesting subject area to watch.