Economic instability, an unpredictable climate, increasingly strong storms, shifting customer expectations and fierce competition. The insurance industry is not immune to changing times, but it is ripe for innovation. Ever-evolving market needs require adaptation for survival and now more than ever, insurance companies are re-thinking claims strategies, technology implementation, how to increase productivity, and ways to better fulfill promises to policyholders.

Solutions such as IMGING On Demand can function as a safeguard for the insurance company; a system to help prepare you for the future and protect you against possible eventualities; a defense against bottlenecks, a catch-all for potential errors, and a catalyst for efficiency. It all begins with data: how it is collected, stored, and analyzed.

Rich Data and a Scalable Platform

It’s no secret that insurance claim management has a direct and substantial effect on customer experience. Top carriers are using artificial intelligence insurance technology to boost customer satisfaction, as part of a mission to “do more with their data.” The IMGING platform makes precise data capture and analysis possible through automated drone flight and A.I, housed in a uniquely capable environment. IMGING On Demand refers to the expert services provided using the IMGING app.

The data captured by IMGING On Demand pilots is detailed and dependable – much more so than information obtained by third-party adjusting firms or ladder assist. It’s all thanks to the intuitive tools built into the IMGING app.

- Inspect List is a guided inspection tool that tells inspectors exactly which elevation photos they must capture.

- Automated flight patterns grant 100 percent property coverage, gathering ultra-high-res imagery needed for photo-realistic 3D models.

- A.I.-powered damage detection automatically identifies rust, hail, missing shingles, or other areas of potential damage, saving adjusters hours of manual review.

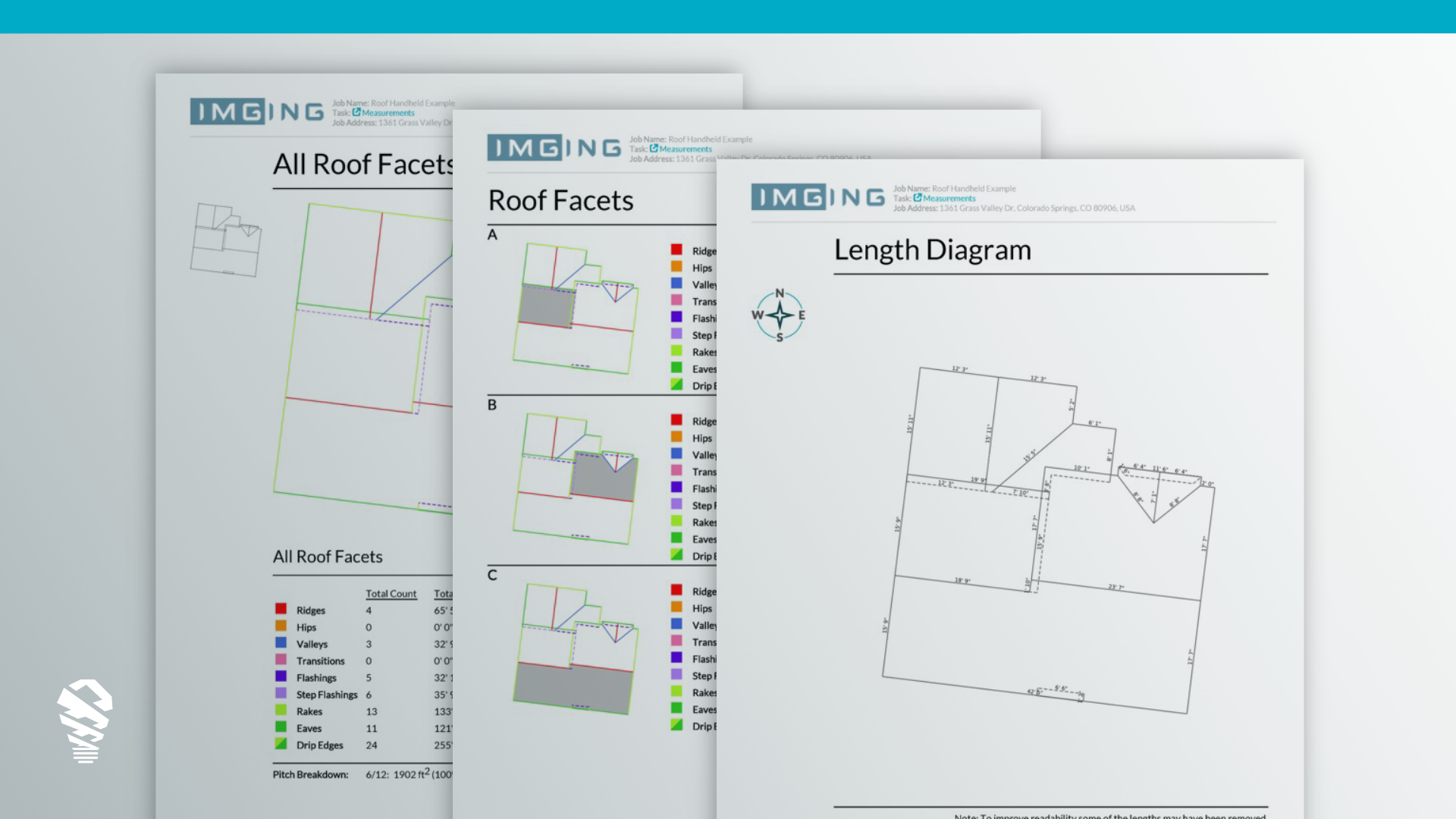

- With accurate, property-wide measurements and elegant reporting tools, adjusters can explore and measure a complete, digital representation of a property without ever stepping foot on-site.

- This data can then be exported as file formats that plug seamlessly into estimating software.

Forget the fuss of SD cards, photo uploading, or file sharing. All data captured on-site can be stored, shared, and accessed through the IMGING app. Images are all GPS-tagged and can be uploaded wirelessly to the cloud. No matter who is gathering the data or analyzing it, all efforts will be aligned. One comprehensive system built for better collection and understanding of data will streamline operations from start to finish.

More Efficient Claims Handling

In the past, the more common approach was to send a field adjuster or third-party hire out to obtain claim information. Considering the cost of this, and the risk of injury or error involved, a more impactful approach would be to focus on a desk-adjusting model and augment your field adjusters in times of need. This will give you more flexibility in allocating adjusting resources, and help you avoid delays in the settlement process, which can frustrate claimants.

Unaided by an A.I.-powered inspection platform, it might take a roof insurance adjuster weeks to settle a simple property damage claim. However, using IMGING, the average flight time for a residential property is just 10 minutes. With twice as much detail and none of the risk involved in putting someone on a roof, carriers can deliver a fully adjusted claim in a few days. With better intelligence comes a more automated claims experience. More efficient claims adjusting will produce more accurate estimates and significantly reduce cycle times, resulting in higher customer ratings and retention.

Reduce Loss Adjustment Expense (LAE)

IMGING On Demand works to prevent losses predominantly through claims related expenses. On its own, the IMGING platform is highly capable in terms of enhancing insurance claim management. However, IMGING On Demand is where insurance organizations will reap major benefits by reducing loss adjustment expense (LAE). Ordering on-demand drone inspections through IMGING On Demand allows carriers to augment their labor force for catastrophic responses or extra coverage in storms and areas with lots of policies in place. This way, they greatly reduce their overall cost per claim by replacing legacy outsourcing options.

There are many costs associated with gathering claim data without even factoring in the cost of the claim itself. If LAE is any expense associated with investigating and settling an insurance claim, then imagine the savings made possible by eradicating needless spending, refining the claims process, and optimizing the workforce needed to complete it. IMGING On Demand combines unmatched data with unmatched service to permit this kind of drastic reduction in loss adjustment expenses.

Final Thoughts

The stakes are high in an unpredictable industry, but insurance organizations could stand to gain from IMGING On Demand. From A.I and deep learning tools to a user-friendly interface and on-demand service, IMGING On Demand delivers the whole data package, giving organizations the competitive advantage. With it, carriers have in their arsenal a fail-safe for the future, and a solution for effecting positive change across carrier operations.