While drones, AI, and other technologies promise to increase insurance carrier productivity, the changing customer, climate, and market means our industry needs a lot more than a few efficiency hacks.

The insurance industry is facing increasingly powerful storms. Insured losses reached $79 billion last year. On top of that, Millennials now dominate our housing market. In the past few years they’ve surpassed Generation X as the group responsible for the most new home mortgages. Millennials are demanding when it comes to customer service and two-thirds of people will quickly end a relationship with a company after a single bad experience.

We need to completely redefine the way we think about property claims and the overall customer experience if we’re going to adapt to the needs of the market.

The first step is changing our relationship with data.

Data Brings a New Gold Rush

Today, insurance carriers are adopting drones, smart devices, AI, analytics, and other InsureTech innovations. The trouble for many claim executives isn’t the lack of solutions, it’s the complexity involved in identifying the right ones, and using them to leverage data in ways that impact loss adjustment expenses and the customer experience. On their own, each of these tools can improve our relationship with data in small ways, but together, they can change the way we understand risks and loss on a massive scale.

Understanding risk and loss across every policy in force isn’t just about how you collect information. It’s about how well you collect it and how well you can use it to inform quick decisions. The future of insurance isn’t just about flying drones or AI chatbots, it’s about creating an arsenal of solutions that work in concert to improve the way we collect and understand multitudes of data.

To adapt to a changing market, insurance carriers must have new ways to digitize property information, analyze it intelligently, and turn their findings into quick actions.

It all starts with using the latest tech to improve data collection in the field.

Automating Data Capture With Drones

When it comes to collecting data, drones are creating incredible new possibilities for insurance carriers. State Farm and Travelers Insurance have publicly discussed using drones for CAT response and other parts of their claim process for years. Drones promise efficiency and superior image quality, plus, they keep their claims adjusters out of harm’s way. These are great benefits, but there’s much more to the story.

By themselves, drones are just tools that aid data capture in the field. They replace a ladder and camera, and some solutions even provide measurements.

The conversation about drones changes drastically when you consider what sort of software powers the platform. An off-the-shelf DJI drone has incredible software for manual flight, but for thorough, consistent data capture, nothing beats an automated flight plan. Anyone with the proper part 107 FAA certification can fly an automated drone with minimal flight training. Flight times are around 10 minutes for an average residential property. The drone data itself is high-quality and consistent on every inspection and it’s relatively easy to scale up a program with such easy-to-use tools.

Yes, drones have incredible advantages for improving and automating claim inspections. But the real game-changing benefits happen after the drone lands.

Creating Digital Twins for Insurance

With the right software and AI behind it, a drone becomes a formidable platform for data gathering, but two-dimensional imagery is something adjusters have been gathering for years. Aren’t aerial photos from a drone just a different way to get similar results? The next step is to take that imagery and thread them together into detailed, explorable, and measurable ultra-high-res digital versions of properties. Gartner and IBM call representations like these digital twins, but whether you call them twins, copies, or representations, these facsimiles are creating new possibilities for insurance carriers.

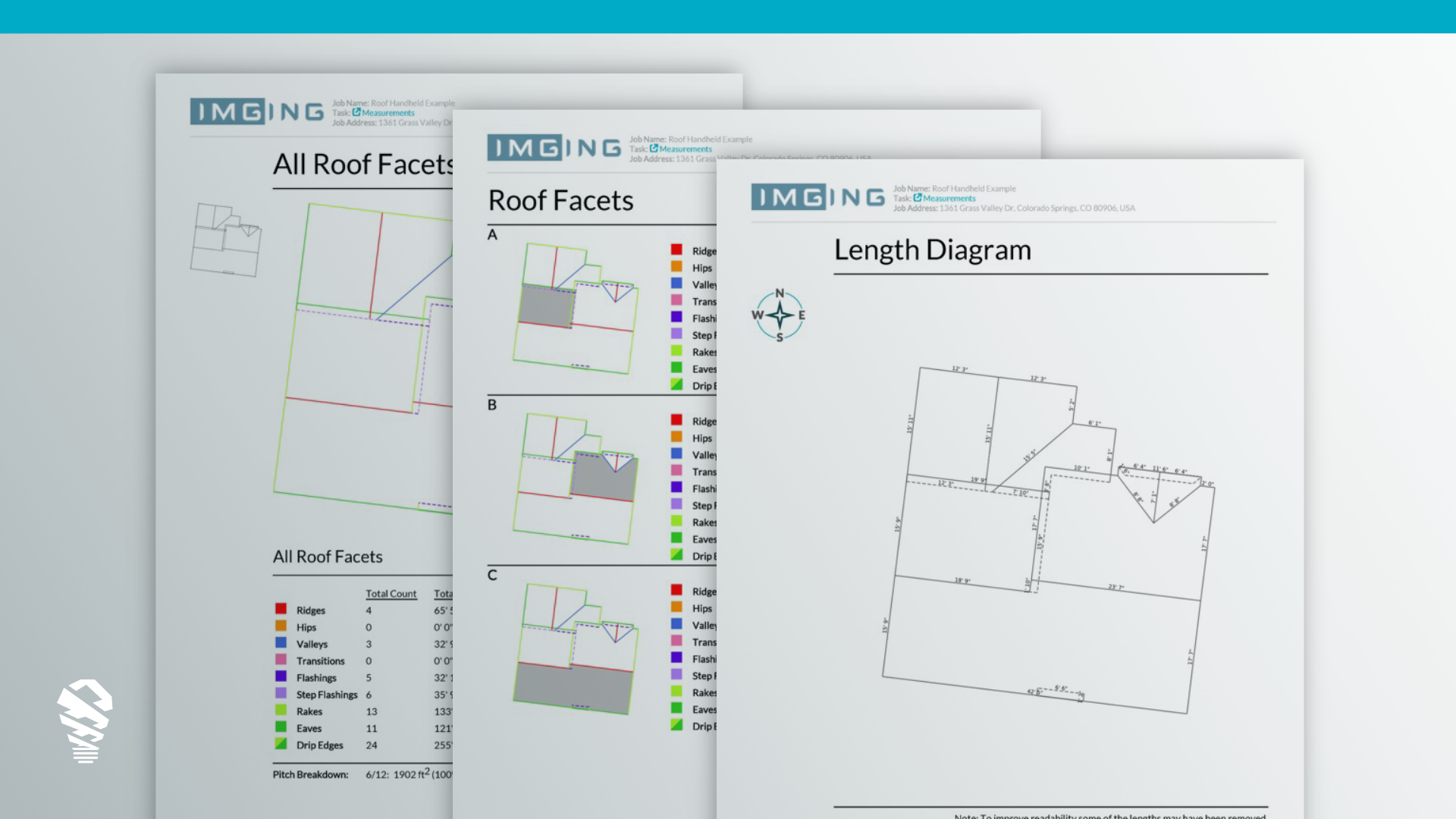

With platforms like IMGING, anyone can fully digitize structures and properties, then pass digital assets to desk adjusters, underwriters, and contractors who can inspect and analyze a claim without being there. Underwriters can check for risks. Fraud teams can identify potential cases of malfeasance. Instead of a few images, carriers can now fully document a property at time of loss with more detail than ever before.

Over time, insurers can gain insight into a property’s overall lifecycle by comparing older digital twins to new ones. In a sense, they create a library of digital assets. They can analyze loss trends across thousands of properties and really unlock the insights hidden in raw, drone-captured data.

Sounds exciting, right? It gets even better.

Powering Customer Experience With Artificial Intelligence

Gartner predicts that twenty-five percent of customer service ops will use virtual assistants or chatbots by 2020. Artificial intelligence has the power to bolster customer service, and even provide instant claim resolutions.

But AI becomes even more compelling when it’s coupled with masses of data collected by a fleet of automated drones. Using drone-captured data, adjusters can use advanced machine learning algorithms to automatically spot damage. Their process becomes simpler, more accurate, and timelier, which reduces cycles times and helps amp-up customer service ratings.

Soon, artificial intelligence will become essential to analyzing trends among large-scale property data sets. Drones will provide the data, AI will make it useful, and people will take action based on the insights. With better intelligence and quicker ways to act, insurers can better plan for tomorrow and help their policyholders do the same.

Redefining Insurance With Data Analytics

With mass stores of data, detailed digital twins, and powerful artificial intelligence, the claim experience becomes more automated. Estimates become more accurate. Risks become easier to identify—both on a macro and micro scale. Gartner also reports that by 2020, 40 percent of all data analytics projects will relate to an aspect of customer experience. Better intelligence and better predictability lets carriers to invest more in policyholder experience. When it comes to the much-needed improvements that will power the future of insurance customer service, data analytics is king.

We won’t change the claim experience for policyholders if we think drones, AI, and other tools are an end in themselves. We must focus on how digitizing properties can help us act quickly and earn more trust with policyholders. Only then can we power new processes that can endure the changing market, climate, and customer.

If you’re curious how a complete drone analytics platform can help you rearchitect your property claims process, reach out to us.