There are many ways insurance professionals can start using drones for things like roof and property inspections. They can go grab a drone off the shelf and learn to fly and capture images manually, but a more popular route is to find a drone solution that takes care of some of the tough work by flying and capturing images autonomously. Whatever you choose, there are some compelling reasons why you should consider a solution built specifically for insurance. And believe me, though some vendors talk a big game, they don’t always understand the nuances of insurance.

Insurance Has its Own Needs

A lot of the drone tech currently available to insurance professionals was initially developed for mining and agricultural purposes. They’re designed to survey crops, capture overviews of spoil piles, and gather imagery over vast areas. Vendors that offer these solutions have vast knowledge when it comes to agriculture and mining, but are playing catchup when it comes to insurance. Though they’ve attempted to adapt their drones for insurance purposes, they fall short of providing insurance professionals with all the things they need.

Why Detail Scans Matter

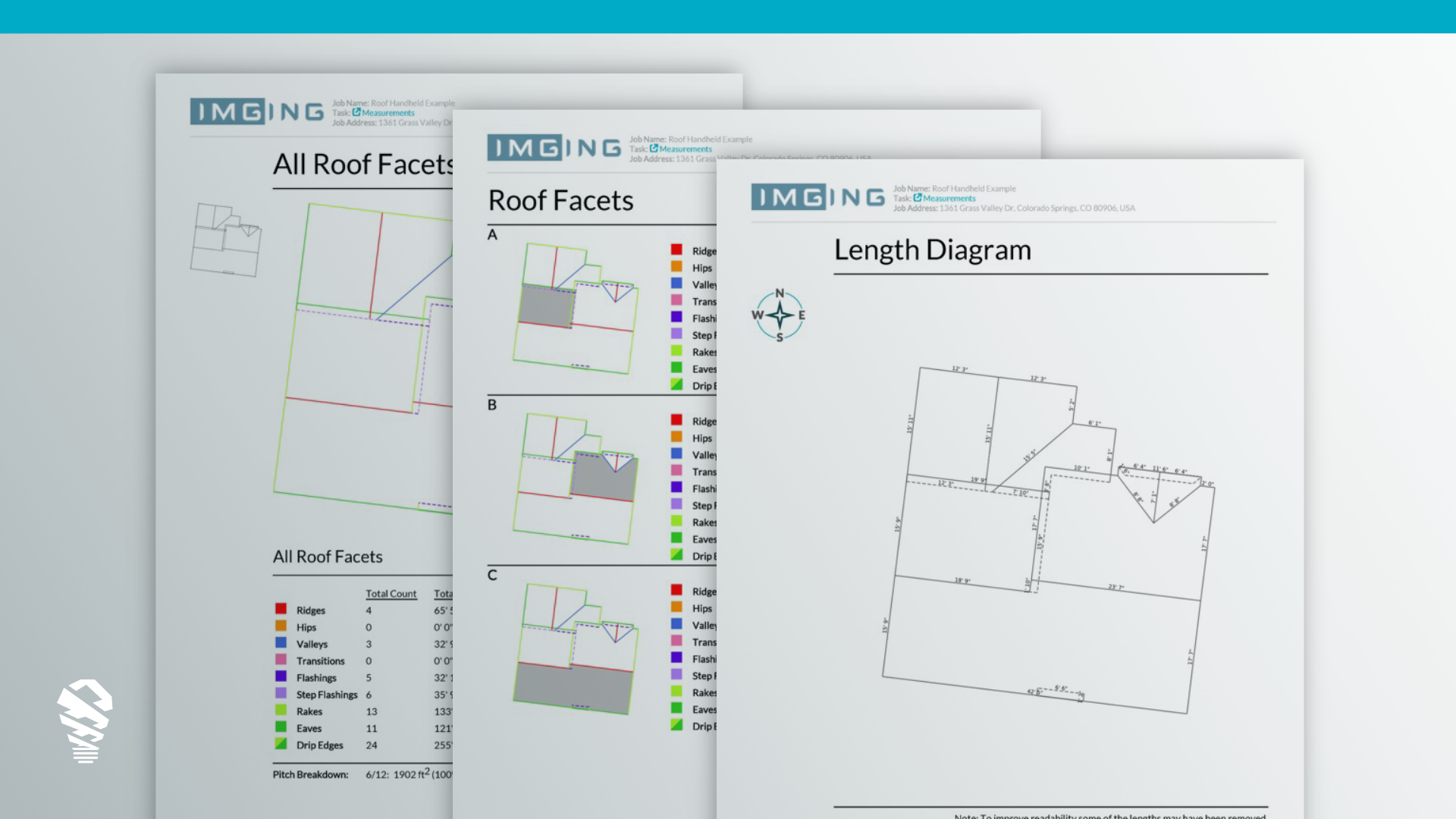

As noted, drone solutions adapted from mining and agricultural purposes are fantastic at getting broad overviews of large areas, but unless a property or roof is an obvious total loss, insurance professionals need details. For a damage claim, insurance professionals must answer questions such as: What caused the loss? What damage was here before the storm or other event? How bad is the damage? What kind of roofing material is this? For underwriting, they’re concerned with the current state and size of the roof and property, what materials are there, and what other features of a property (pools, trampolines, fences) might affect a policy. Sweeping imagery can help insurance pros get a vague understanding, but to really know the state of things, they need drone solutions built to capture the ultra-high-resolution imagery they need to understand all the facts.

You Shouldn’t Have to Change How You Work

Details aren’t just important for imagery, they’re also important for insurance workflows. Some vendors pay lip service to insurance pros, but don’t understand exactly how they get their jobs done. An insurance-focused drone solution will allow you to create and manage jobs, attach claim and policyholder information to each job, as well as develop reports built to suit the needs of underwriters, adjusters, and other insurance professionals. Whatever drone solution you choose, it’s wise to consider how using that tool will fit in with your claims and underwriting process on a large scale. Only those truly built for insurance will stand up to the test.

Price and Scale Lead to More Adoption

Many insurance drone solutions on the market carry a hefty price tag – sometimes as high as $50K per drone. That might be acceptable to a large mining operation or commercial farm, but for the everyday insurance pro, it’s impractical. While the benefits of a drone solution are obvious on the scale of a single adjuster (better speed, safety, and consistency), those benefits multiply by how many drones are in the field, and high-cost solutions require much more upfront investment and could take years to pay for themselves (if they ever do). Any drone solution for insurance should be affordable enough to put in the hands of hundreds of adjusters across the country. This lets carriers and adjusting firms maximize the benefits of drone tech, while also enabling them to better respond to large disaster events, such as Hurricane Harvey, Hurrican Irma, and Hurricane Maria.

Better Support and Product Road Map

Some vendors don’t understand insurance as well as others and they are not able to offer the same quality support for those who run into issues or want advice on how to get the most from the drone tools. Also, vendors with more insurance experience will be more receptive to your thoughts on features product enhancements, and other developments because their goal is to help you do your job better. When you look at drone vendors, take time to look at their product road maps to see how well-developed their strategy is, and how well that fits with your needs as an insurance pro.

Last Thoughts

Insurance matters. People count on insurance professionals to help them when things get tough. Tools for insurance professionals need to be built to work the way they do. As you evaluate vendors to help you meet your technology goals, be sure that insurance isn’t an afterthought or just another chance for the vendor to make a quick buck. If you choose vendors dedicated to the kind of work you do, you can be positive you’ll be better empowered to get more done and help more people.

Want to see how an insurance-focused drone solution can make your life easier? Meet IMGING, the industry’s first insurance drone solution.