The insurance industry is experiencing big changes for the first time in a long time. As technology evolves and customer demands and expectations change, professionals in all industries need to adapt or get left behind. For insurance adjusters, drones are the next great way to make customers happy. Drones aren’t just a cool alternative to traditional insurance adjusting, they’re becoming imperative for insurance carriers hoping to meet their goals.

Traditional insurance adjusting is a time-consuming process. After arriving at a property, an adjuster might need a messy truckload of equipment ranging from ladders to smart phones, tape measures, and clipboards just to get the information they need. This can take an hour or depending on the roof. When insurance adjusters have drones, they can finish an entire inspection and leave the job in as little as 10 minutes. They can fly manually or if they need measurements create an automated flight plan and send it on its way to collect roof data. The average flight time of IMGING’s automated inspection for a residential home is now under 5 minutes. This speed advantage allows adjusters to visit more properties each day and double—maybe triple their output.

Traditional insurance adjusting is a time-consuming process. After arriving at a property, an adjuster might need a messy truckload of equipment ranging from ladders to smart phones, tape measures, and clipboards just to get the information they need. This can take an hour or depending on the roof. When insurance adjusters have drones, they can finish an entire inspection and leave the job in as little as 10 minutes. They can fly manually or if they need measurements create an automated flight plan and send it on its way to collect roof data. The average flight time of IMGING’s automated inspection for a residential home is now under 5 minutes. This speed advantage allows adjusters to visit more properties each day and double—maybe triple their output.

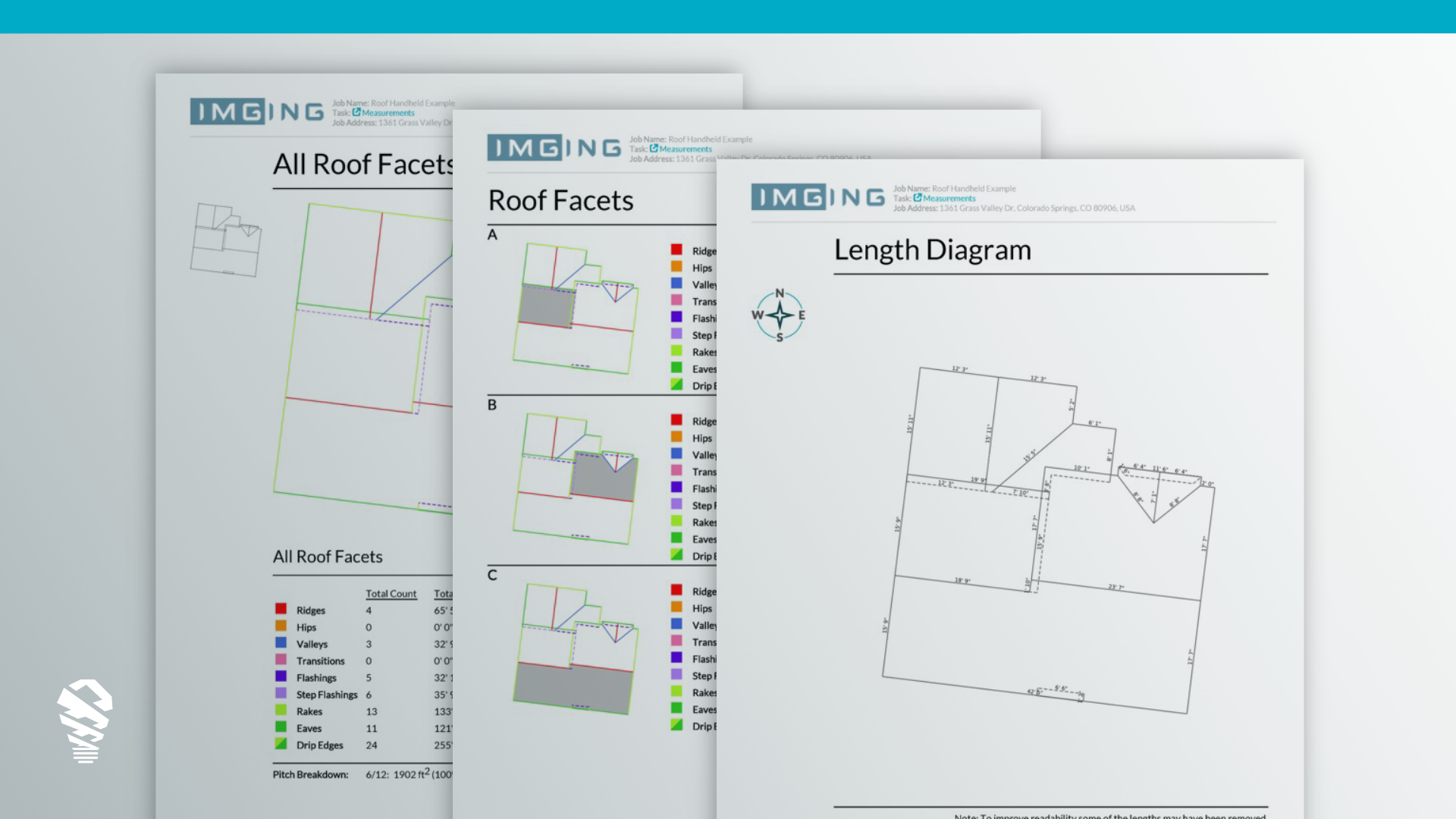

Drones often integrate with software that helps insurance adjusters do their jobs better. The leading drone solutions go beyond imagery and have artificial intelligence and deep learning capabilities that help adjusters analyze what is in each image. AI is not here to replace adjusters, but to augment their work. This technology can detect dozens of damage types and acts as a time saver for adjusters as it draws their eye to the important details. Adjusters can know that they have identified all the damage and have great data to support their decision making during the adjusting and claims process.

Drones often integrate with software that helps insurance adjusters do their jobs better. The leading drone solutions go beyond imagery and have artificial intelligence and deep learning capabilities that help adjusters analyze what is in each image. AI is not here to replace adjusters, but to augment their work. This technology can detect dozens of damage types and acts as a time saver for adjusters as it draws their eye to the important details. Adjusters can know that they have identified all the damage and have great data to support their decision making during the adjusting and claims process.

Incredible Increase in Speed and Resolution

Traditional insurance adjusting is a time-consuming process. After arriving at a property, an adjuster might need a messy truckload of equipment ranging from ladders to smart phones, tape measures, and clipboards just to get the information they need. This can take an hour or depending on the roof. When insurance adjusters have drones, they can finish an entire inspection and leave the job in as little as 10 minutes. They can fly manually or if they need measurements create an automated flight plan and send it on its way to collect roof data. The average flight time of IMGING’s automated inspection for a residential home is now under 5 minutes. This speed advantage allows adjusters to visit more properties each day and double—maybe triple their output.

Traditional insurance adjusting is a time-consuming process. After arriving at a property, an adjuster might need a messy truckload of equipment ranging from ladders to smart phones, tape measures, and clipboards just to get the information they need. This can take an hour or depending on the roof. When insurance adjusters have drones, they can finish an entire inspection and leave the job in as little as 10 minutes. They can fly manually or if they need measurements create an automated flight plan and send it on its way to collect roof data. The average flight time of IMGING’s automated inspection for a residential home is now under 5 minutes. This speed advantage allows adjusters to visit more properties each day and double—maybe triple their output.

No More Falls From Roofs

When an adjuster climbs on a roof, the risk of falling is always present. Falls can have major consequences for an insurance carrier and the adjuster. Falls aren’t cheap for a company and they can physically incapacitate proficient workers, cause psychological damage and death in the worst cases. With a drone, insurance adjusters never have to run the risk of falling. They can inspect an entire roof from the safety of the ground. Additionally, this makes saving on workers’ comp rates for some or all property adjusters a reality.Innovative Tech Features

Drones often integrate with software that helps insurance adjusters do their jobs better. The leading drone solutions go beyond imagery and have artificial intelligence and deep learning capabilities that help adjusters analyze what is in each image. AI is not here to replace adjusters, but to augment their work. This technology can detect dozens of damage types and acts as a time saver for adjusters as it draws their eye to the important details. Adjusters can know that they have identified all the damage and have great data to support their decision making during the adjusting and claims process.

Drones often integrate with software that helps insurance adjusters do their jobs better. The leading drone solutions go beyond imagery and have artificial intelligence and deep learning capabilities that help adjusters analyze what is in each image. AI is not here to replace adjusters, but to augment their work. This technology can detect dozens of damage types and acts as a time saver for adjusters as it draws their eye to the important details. Adjusters can know that they have identified all the damage and have great data to support their decision making during the adjusting and claims process.