The insurance industry takes a meticulous approach to innovation and insurers only consider the most viable new technologies for adoption. Led by a handful of forward-thinking carriers, the industry has been using and testing drone solutions to see whether they can improve accuracy and speed, or even provide alternative workflows that can streamline claims. Drones are keeping adjusters safe on the ground, and in many cases, they save adjusters time. But can they make a significant impact on loss adjustment expenses?

In this piece we’ll examine two popular ways to use drone solutions for claims and analyze the potential impact they can have on loss adjustment expenses, cycle times, and ultimately the combined ratio.

In-House Drone Solutions

There are two main ways carriers are using drones in house. One approach involves equipping existing field adjusters with drones to streamline inspections and increase adjuster output. The other is to use a specialized team of pilots to inspect and gather data for desk adjusters. This lets carriers keep skilled adjusters focused more on analyzing information, and less time on gathering it. Here’s a look at the potential benefits of an in-house program:

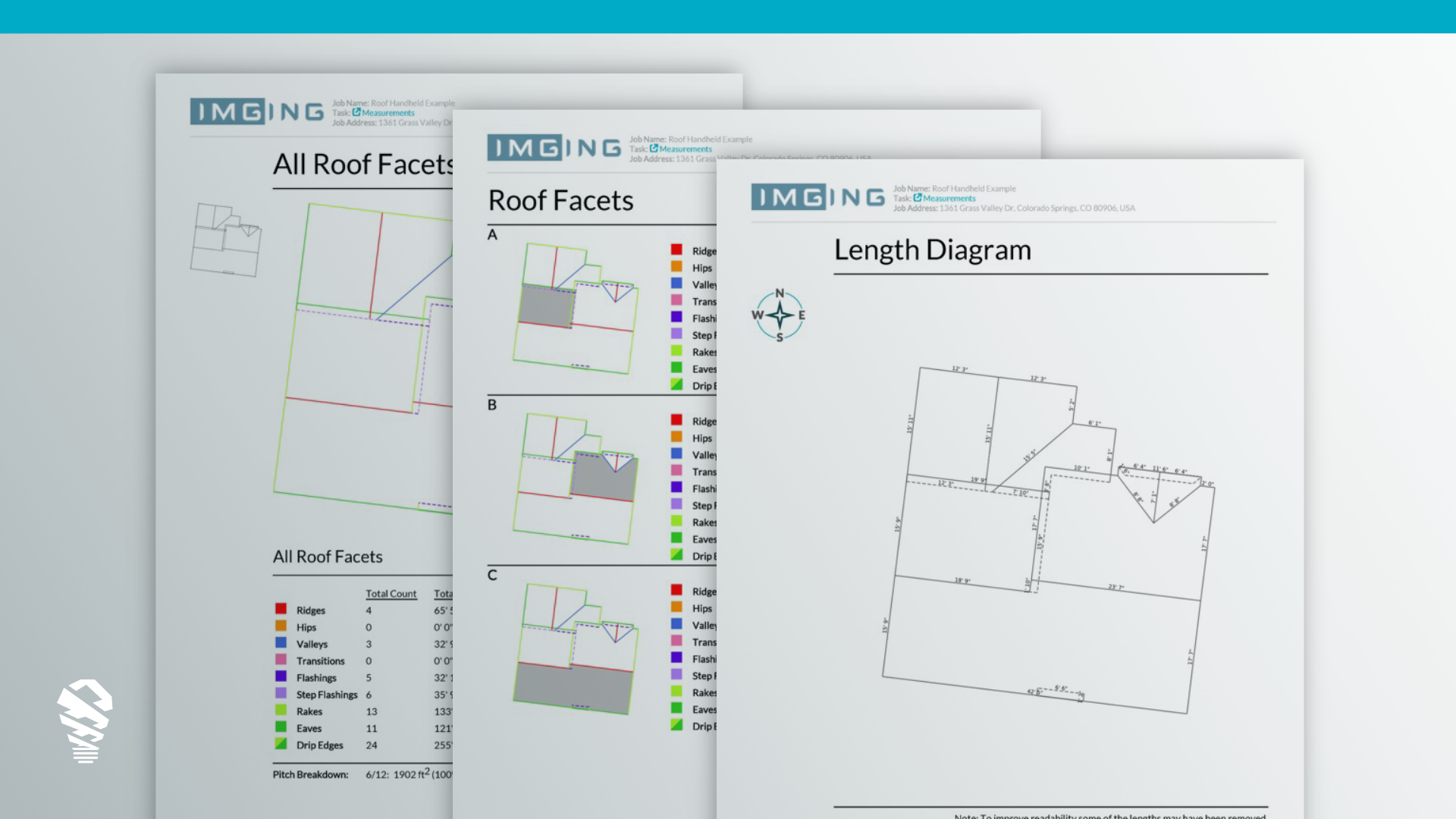

- Improved Output – With flight times as low as 12 minutes (average flight time for IMGING), and improved data, drone solutions can improve the entire the entire claim cycle — from FNOL to settlement.

- Reduced Costs Per Claim – Developing an in-house program reduces LAE expenses by allowing carriers to complete more claims more quickly.

- Ability to Focus Skilled Labor on Desk Adjusting – Drones make desk adjusters more productive because drone field inspections don’t require the expertise of a seasoned adjuster. On top of this, a fully burdened pilots’ salary is an average of $40K-$55K/year compared to $84K/year for an adjuster.*

- Customer Satisfaction – According to JD Power studies, quicker claims resolution has a direct correlation with improved customer satisfaction scores.

Outsourcing Drone Solutions

The second method of drone integration is outsourcing a third party for drone inspections. Using these services is a viable option when an insurer needs to scale up field or desk adjustment labor (such as during a CAT). Some services even offer a way to give insurers fully adjusted claims. Let’s dig into some of the benefits that come from outsourcing a drone solution.

- Replace Ladder Assist – Drone inspections offer data that is more thorough and consistent than adder assists can provide. Drones gather high-resolution imagery and to-the-inch measurements.

- Scale-Up Operations – Outsourcing drone solutions can help insurance carriers improve and maintain cycle times and close more claims during stressful, high-volume events like a CAT.

- Reallocate Adjuster Labor – Drones can help adjusters spend less time in the field and more time on claims because third-party pilots gather the data they need.

- Adjust Fewer Claims In-House – Instead of handling claims internally, insurers can take advantage of a fixed rate for each structure involved in a claim and let third parties fully adjust it. This can help them devote internal resources to other parts of the customer experience.

Conclusion

While some insurers will use one of the methods above, it’s also common to use a hybrid model that includes outsourced drone-inspections as well as an in-house program. As we explore more thoroughly in our ebook, there are pros and cons to each method, but both are benefit-rich ways to incorporate drone solutions into just about any claims workflow.

*Average salary for drone pilot: $30K – $40K / year (Common salary via Indeed.com) Average benefits package of private employee: 30.5% of base salary (https://www.bls.gov/news.release/pdf/ecec.pdf) Total cost of pilot annually: $40.5K – $54K

Average salary of insurance adjuster: $64,690 per year (https://www.bls.gov/ooh/business-and-financial/claimsadjusters-appraisers-examiners-and-investigators.htm) Average benefits package of private employee: 30.5% of base salary (https://www.bls.gov/news.release/pdf/ecec.pdf) Total cost for adjuster: $84,420