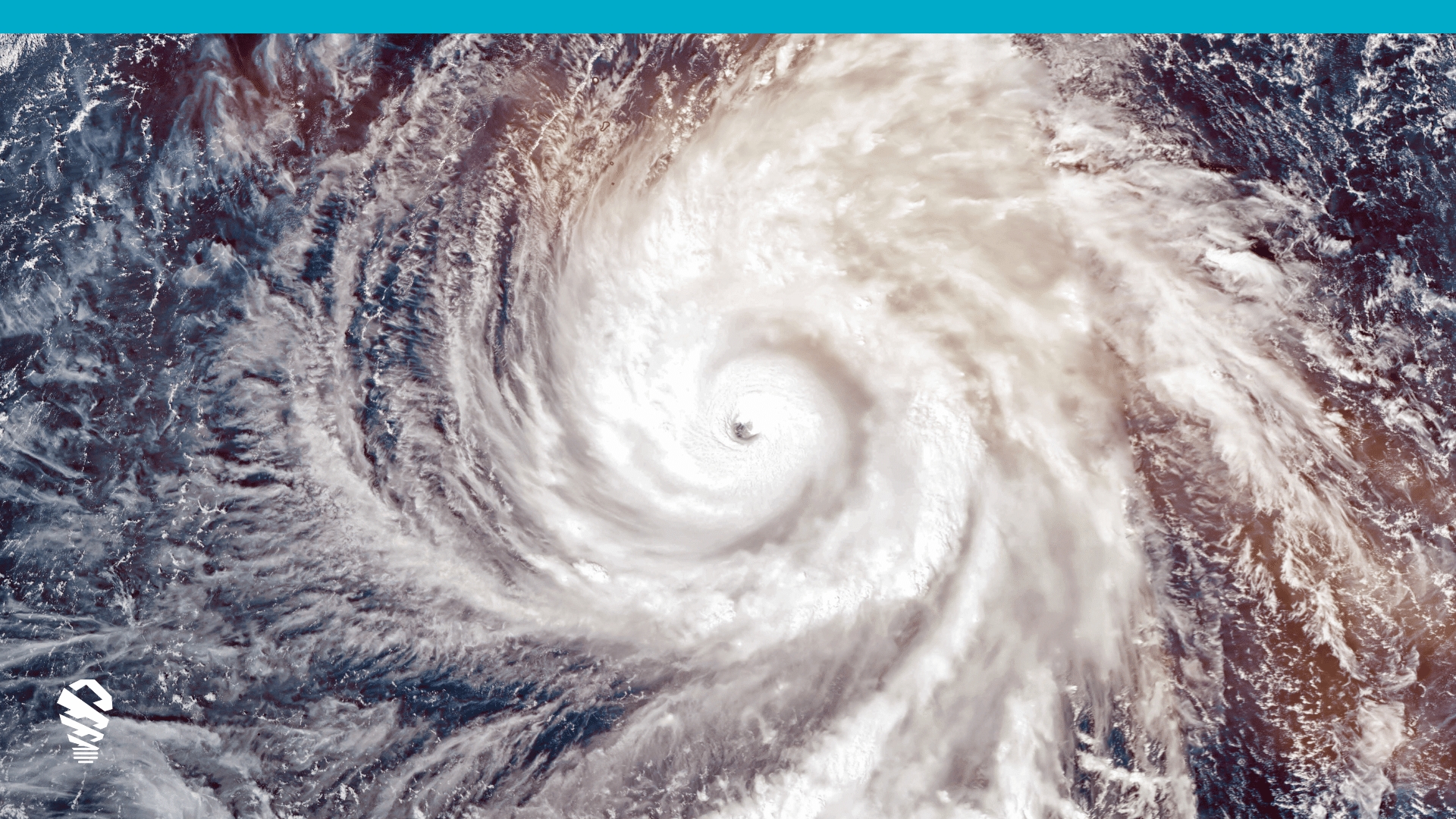

As 2026 begins, some things are changing. Others are staying firmly the same. And anytime an industry experiences a major policy or economic shift, it’s natural to pause, take stock of where we’ve been, and reassess what the future holds.

The sunsetting of the federal solar tax credit has dominated headlines and conversations throughout the past year. We’ve heard the same question repeated over and over:

What happens to solar after the tax credit ends?

Outside the industry, the question sometimes carries a sense of doom. Inside it, the perspective is very different.

To understand where solar is headed in 2026, it helps to start with where it came from.

From Incentive-Driven to Infrastructure-Level

Over the past few years, the solar industry hasn’t just changed who receives incentives—it’s changed how much room there is for error in every project. What once allowed flexibility now demands precision, especially as financing takes a more central role.

2024

Incentives act as a cushion. Sales urgency dominates, and projects often move forward quickly. Even when assumptions aren’t perfect, tax credits and demand help carry deals across the finish line.

2025

The transition year. Ownership still works for some customers, but it no longer carries deals on its own. Installers begin to feel the shift: tighter scrutiny, more stalled approvals, and less tolerance for assumptions that once passed without question.

2026

The margin for error shrinks. Ownership credits sunset, and incentives shift upstream to financiers and aggregators. Benefits are applied within structured programs, and projects are evaluated through a production and risk lens from the start.

Looking Ahead to 2027

The market continues—but expectations change. Incentives remain accessible within program structures, yet projects succeed or fail based on accuracy, predictability, and confidence in projected performance. The systems that move fastest are the ones that pass review the first time.

New Economic Policies Are Raising the Bar

The expiration of the Investment Tax Credit marks a meaningful shift, but it’s important to keep perspective. Incentives represent one part of one pillar of solar’s overall value—not the foundation of the entire industry.

For homeowners and system owners alike, solar’s value still rests on three core pillars:

- Energy savings

- Property value

- Incentives

In 2026, energy savings remain strong—arguably stronger than ever. Electricity rates remain high, power demand continues to climb, and solar’s ability to offset monthly utility costs is unchanged.

Solar has historically contributed positively to home resale value, particularly for owned systems in markets with high electricity rates. While the exact premium varies widely, buyers tend to view solar as an asset when it delivers clear energy savings and predictable performance. As financing models evolve, the emphasis shifts from headline value estimates to documented system output and long-term reliability.

Where the shift occurs is in the incentive pillar. The tax credit may be ending, but broader provisions from the Inflation Reduction Act remain in place, along with state-level rebates and incentives.

The message is clear: solar’s value isn’t disappearing—but the margin for error is.

What Is a TPO—and Why It’s Reshaping Solar Projects

As incentives shift, Third-Party Ownership (TPO) models are becoming increasingly influential.

TPO photovoltaic systems are financing structures where a third party, typically a solar leasing company or Power Purchase Agreement (PPA) provider, owns the system installed on a homeowner’s property. The installer designs and builds the system, the financier owns it, and the homeowner benefits from the energy produced.

For installers, TPO models offer access to customers who may not have upfront capital and provide consistent project volume through financier partnerships. But they also introduce new constraints.

In a TPO project, the system must meet two sets of expectations:

- The homeowner’s energy needs

- The financier’s return requirements

That dual accountability raises the stakes.

The TPO Challenge: Change Orders & Rejections

TPO projects are far more sensitive to inaccuracies than customer-financed systems.

One of the most common friction points in third-party ownership workflows is financing review. Among projects that are rejected by lenders or aggregators, issues with shading and production modeling consistently emerge as leading causes—particularly when site surveys rely on outdated or low-resolution data rather than current, precise measurements.

Rejected submissions aren’t just paperwork setbacks. They introduce costly change orders, delay project timelines, and squeeze installer margins. In a model where financiers are evaluating solar systems as assets with expected production and financial returns, predictability and data quality become critical from the very first design.

In a post-tax-credit world, accuracy isn’t a differentiator. It’s a requirement.

In practice, accuracy shows up most clearly during financing review. In a recent study of TPO project submissions, IMGING projects were approved on the first submission 92% of the time—an 8% improvement over the closest competing solution.

That difference matters. First-pass approval reduces redesign cycles, eliminates avoidable change orders, and shortens time to install. For installers working within TPO and incentive-backed program structures, approval confidence directly impacts margins and throughput.

Avoiding Change Orders Starts with Better Data

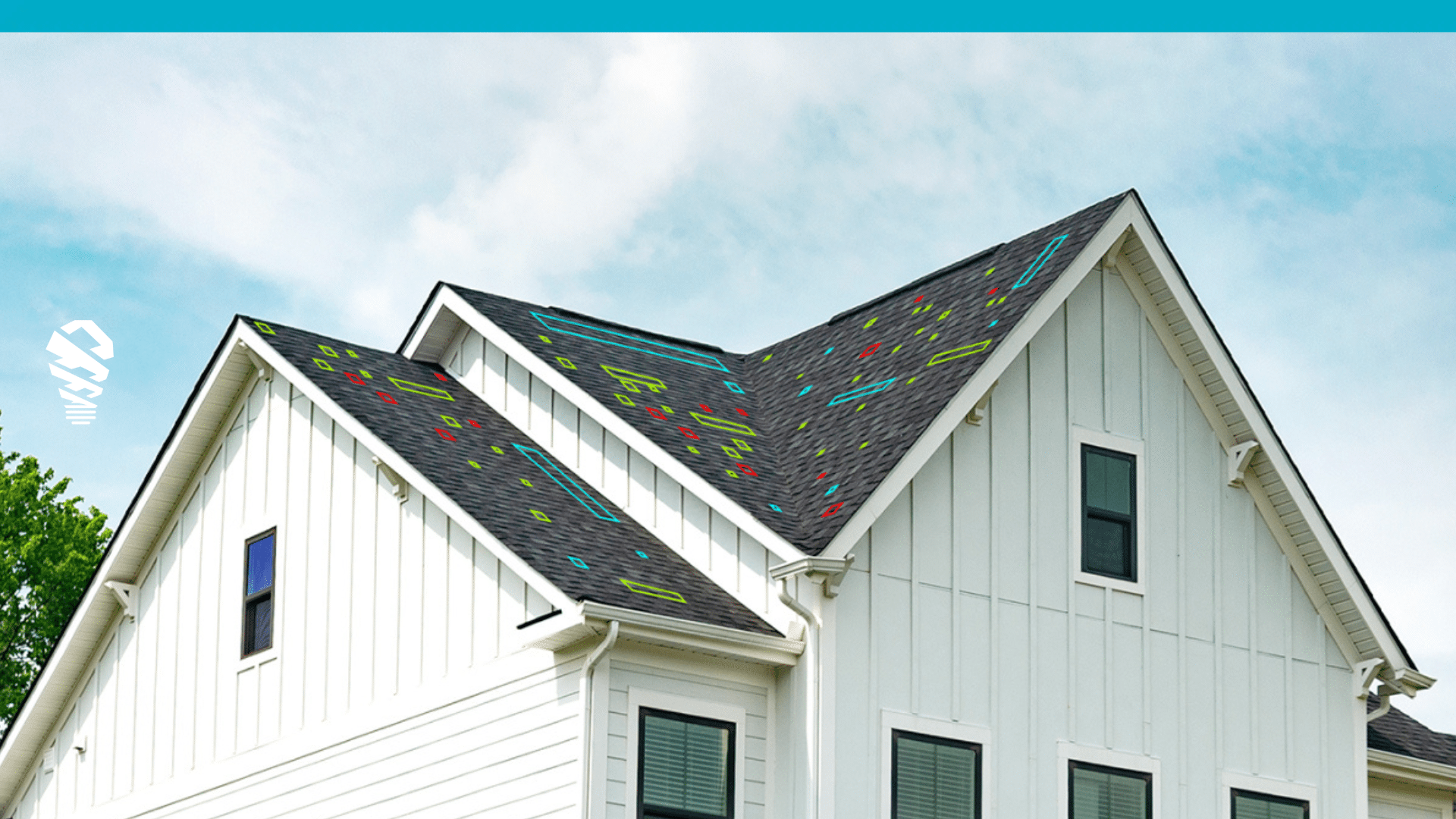

Accurate shading assessment is one of the most critical factors in TPO success. Shade directly affects panel placement, system output, and long-term profitability.

Modern shade tools have evolved dramatically over the past decade, but not all data is created equally. IMGING approaches shading with a level of precision designed specifically for today’s financial and regulatory realities.

IMGING calculates roof shade in six-by-six-inch roof squares, every hour of the year. This methodology, validated by DNV and accepted by lenders, provides production estimates that stand up to scrutiny.

By leveraging drone-captured site surveys, installers gain access to the most accurate and current topographical and obstruction data available. IMGING also enables modeling of future changes—accounting for vegetation growth, removal, or nearby construction—so one site capture can support long-term performance projections.

The Future is Accuracy

As incentives evolve and financing models tighten, solar is becoming less forgiving of guesswork.

In 2026, successful solar projects will be defined by who can design with confidence, submit without rework, and deliver exactly what was promised.

- TPO systems demand data-accurate precision.

- Financiers demand certainty.

- Homeowners demand performance.

And in this new solar landscape, data accuracy isn’t just helpful—it’s everything.

Want to learn more? Fill out the form below and our team will reach out.

![How to Measure a Roof With a Drone [Updated April 2023]](https://www.lovelandinnovations.com/wp-content/uploads/2024/04/How-to-Measure-a-Roof-With-a-Drone-Updated-April-2023.png)